For a detailed list of specific changes to the Property Transfer Tax form, visit the Ministry of Finance Information for Legal Professionals. For any questions on completing the Property Transfer Tax form, please contact the Ministry of Finance Property Transfer Tax Helpline at 236-478-1593 or 1-888 841-0090 (toll free within BC).

Property Transfer Tax (PTT) webforms submitted using LTSA Enterprise are retained for 15 calendar days and available in the Transaction History of Property Transfer Tax Account Management. See View PTT Information. For webforms submitted more than 15 days ago, please contact the Ministry of Finance Property Transfer Tax Helpline at 236-478-1593 or 1-888 841-0090 (toll free within BC).

The PTT webform cannot be submitted by itself. It must be submitted in the same web filing package as the webform that creates the PTT liability and sequenced immediately following that webform

Existing PTT Payment Profiles on the Electronic Filing System (EFS) are referenced when using the PTT Webforms. See Modify a PTT Account

The following is needed for the PTT webform to validate successfully

- All SIN and DOB for Parties involved in the transfer

- All information regarding Non-residents or Corporations

- BC Assessment information for all properties in the transfer

Other helpful information

Completing the Property Transfer Tax Webform

Locate then navigate to your web filing package

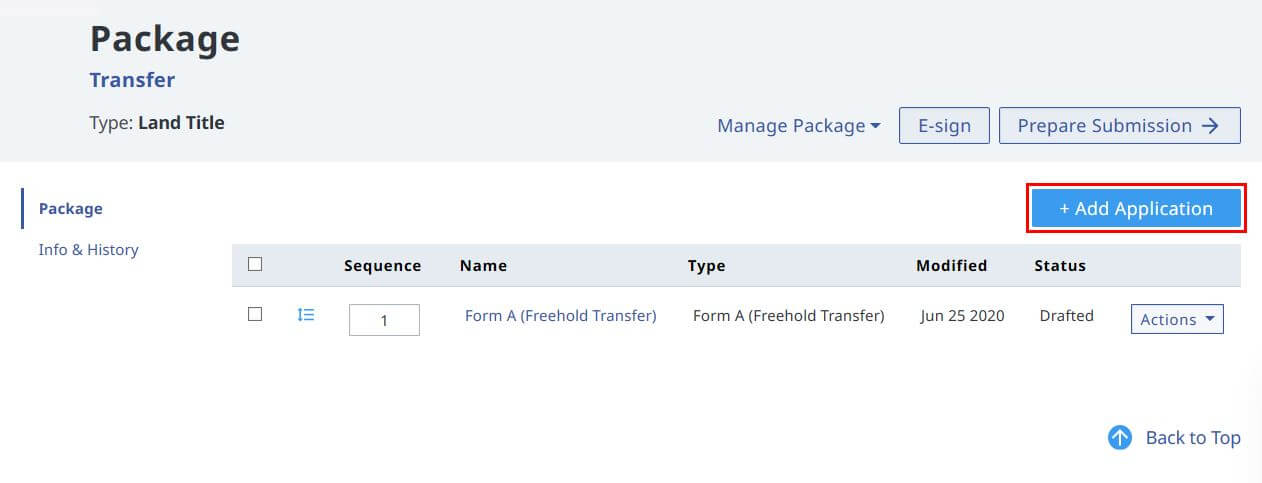

On the Package page click + Add Application

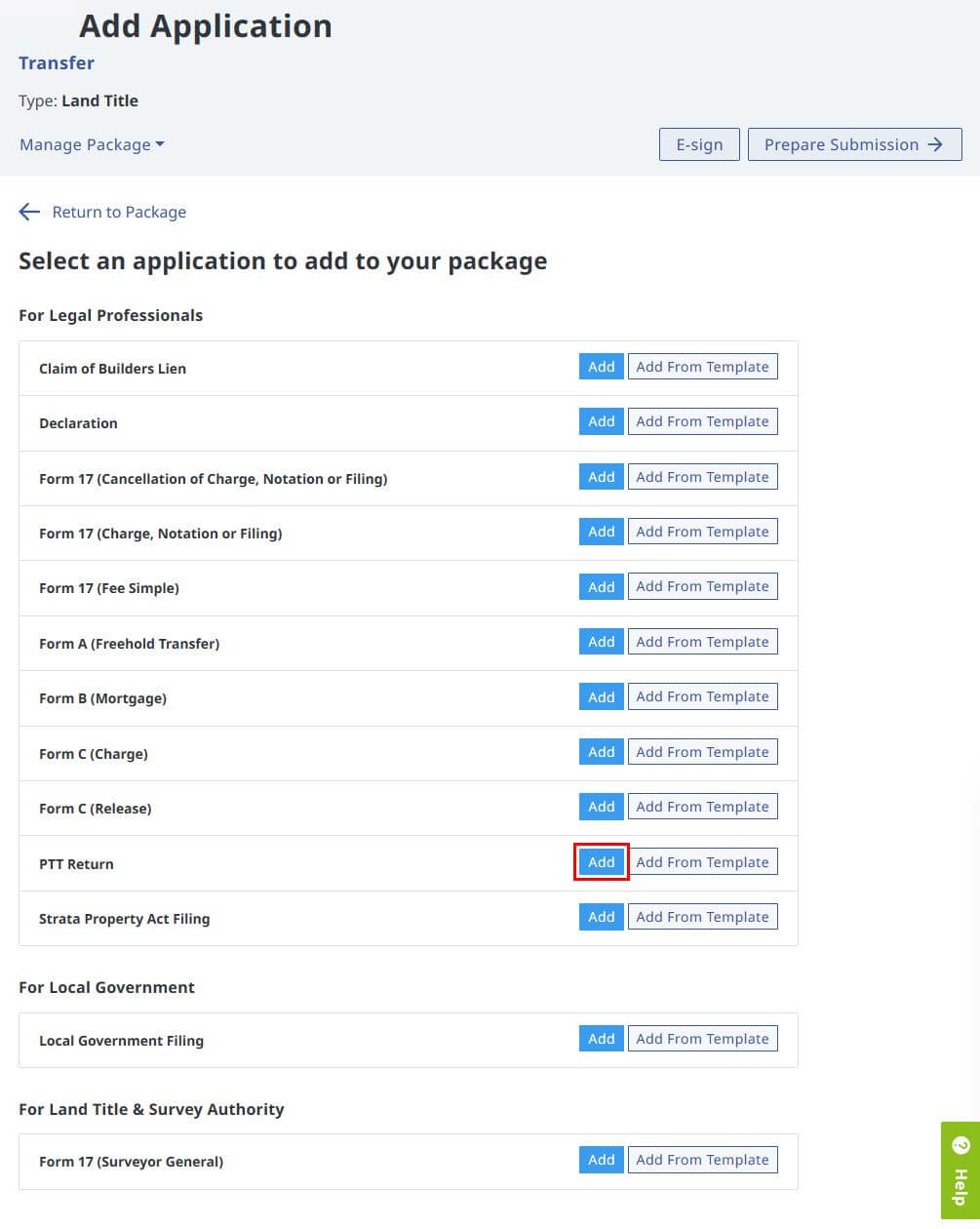

On the Add Applications page click Add to select including a PTT webform to your package

Begin entering data onto the PTT webform [Part A - Part I]. See Information for Legal Professionals on Filing Property Transfer Tax

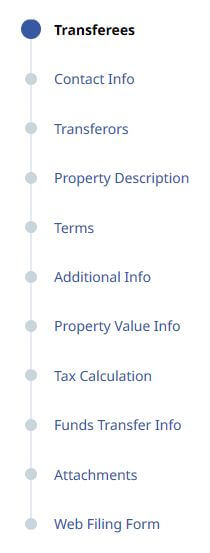

A side panel navigation / status guide is on the left to provide visual notice of the editing stage you are in on the webform

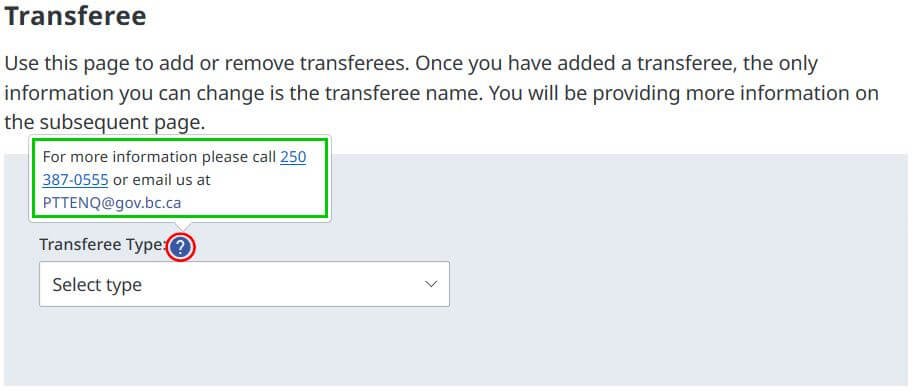

The blue circled question mark displayed beside a term or phrase is clickable On Page Help

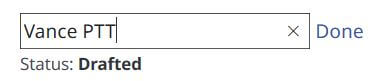

The PTT webform label can be renamed. Click the pencil icon and edit the label (30-character limit), click Done to complete the entries

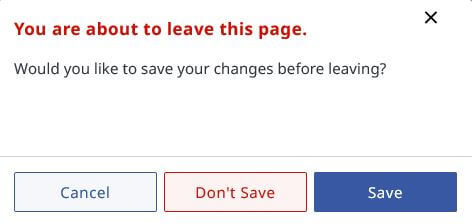

Click Save to the pop-up notice to retain your completion status if you decide to leave at any stage of editing the webform. Click Cancel if you want to remain in the same page

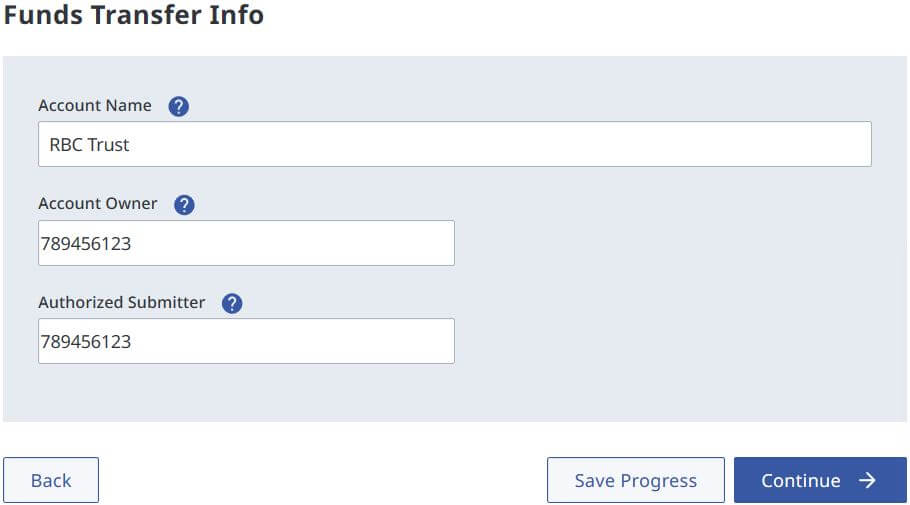

Enter the funds transfer information [Part J]. Click Continue

Data field entries here must match whatever is currently registered with the existing PTT Payment Profile. See view, add or update the PTT Payment Profile

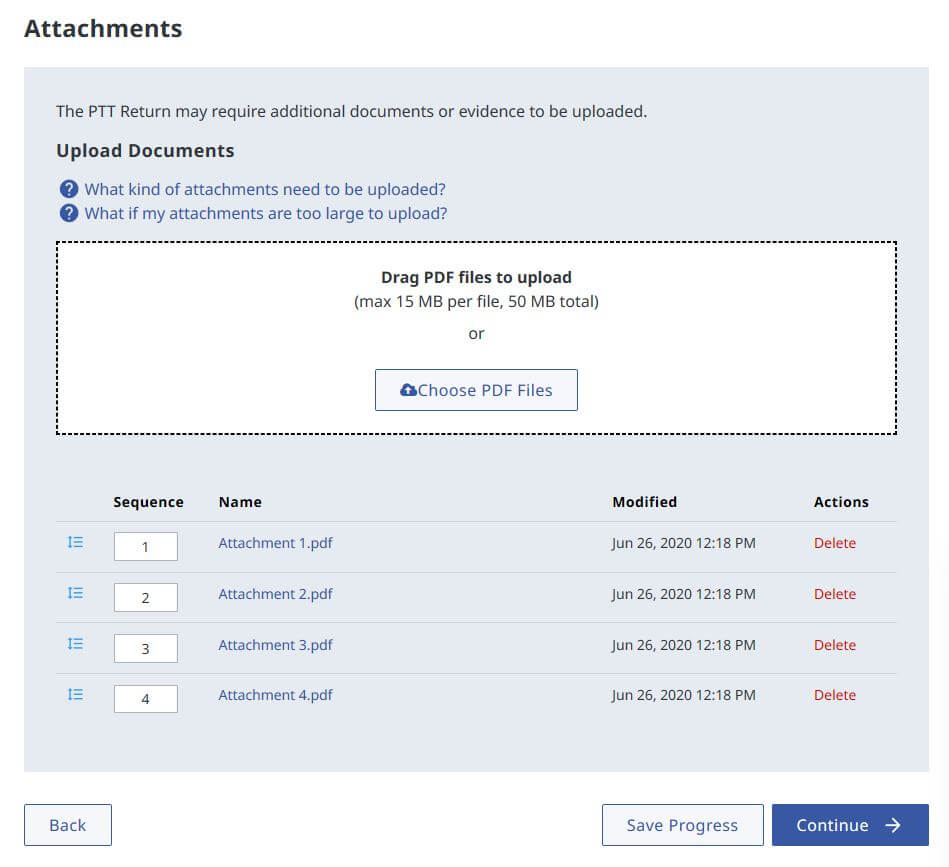

On the Attachments page, upload required additional documents or evidence either by dragging the PDF file(s) onto the box in the page, or clicking Choose PDF Files to search for the file(s) in a browser upload window. If required, rearrange the sequence of attachments. Click Continue

PTT webform requiring additional documents will allow any number of attachments but the file(s) must be in Adobe Acrobat PDF (*.PDF) format. Each individual file is limited to a maximum size of 15MB, and the total sum of all files added must be less than 50MB. See Scanning Requirements

If your attachments are over the limit, contact the Ministry of Finance Property Transfer Tax Helpline at 236-478-1593 or 1-888 841-0090 (toll free within BC) or pttenq@gov.bc.ca and reference your file number

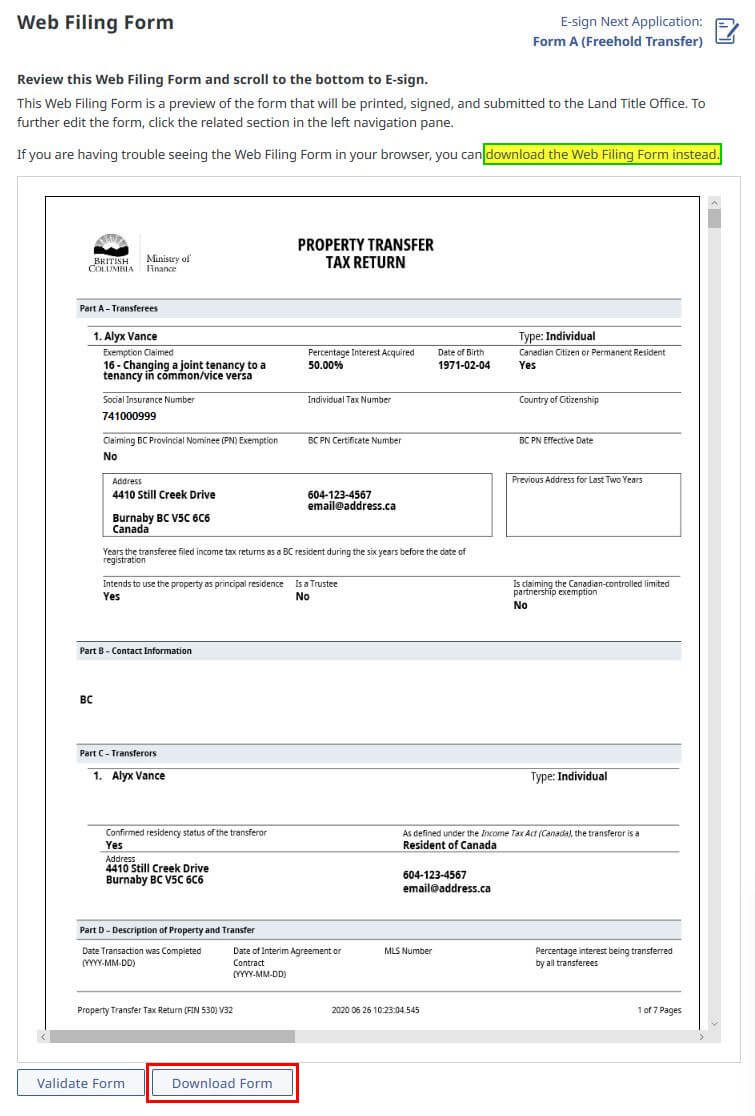

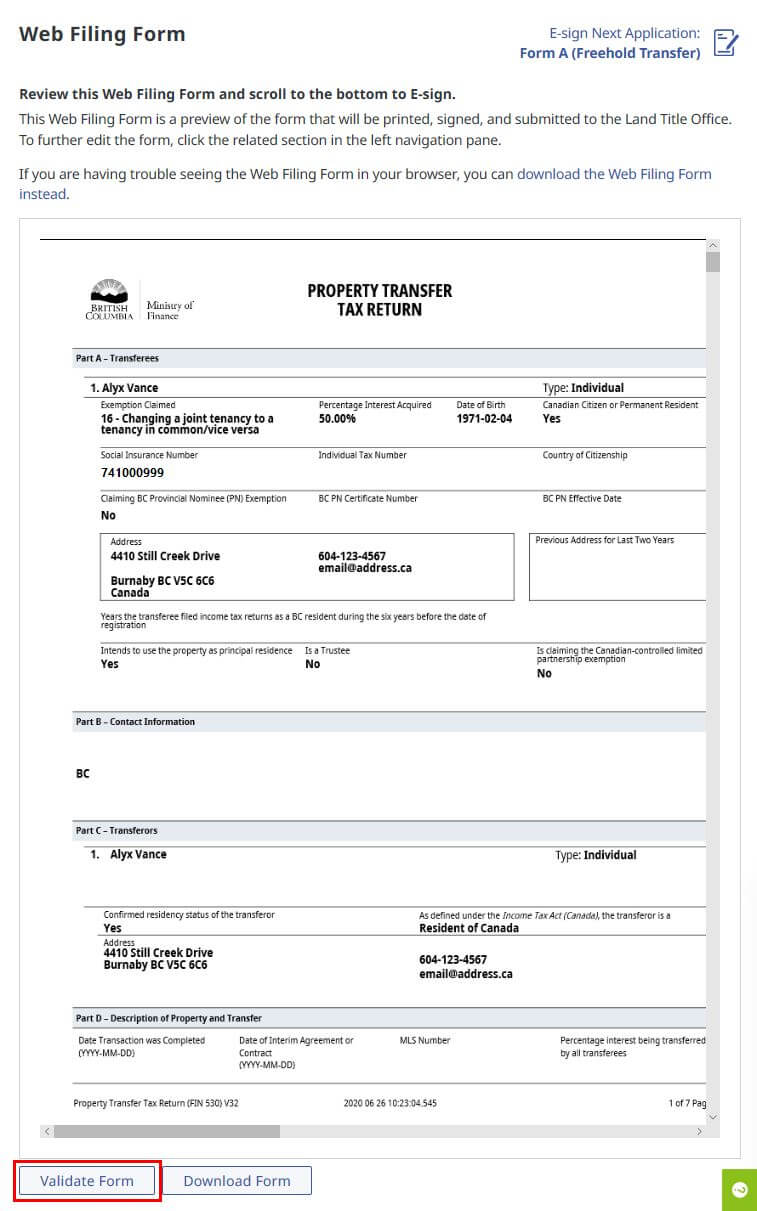

On the Web Filing Form page click Validate Form to confirm the correctness of the entries on the data fields of the form

The validation process on web filing is limited to data field errors. It will not review legal correctness of the entries, similar to what is on the Electronic Filing System (EFS)

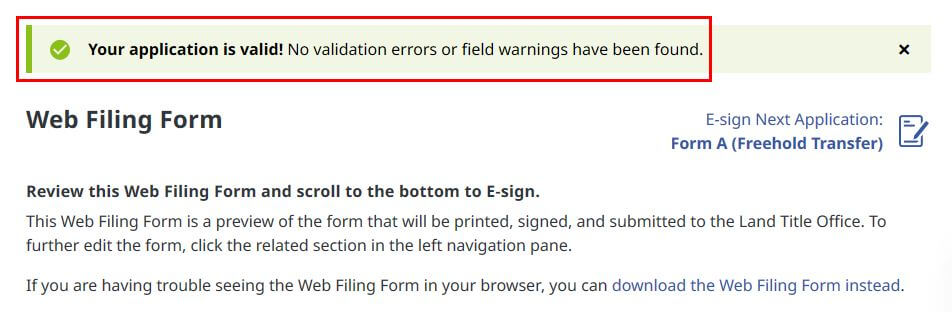

A confirmation message appears. If no validation errors are found continue on to download the form for signing and / or prepare for E-signing

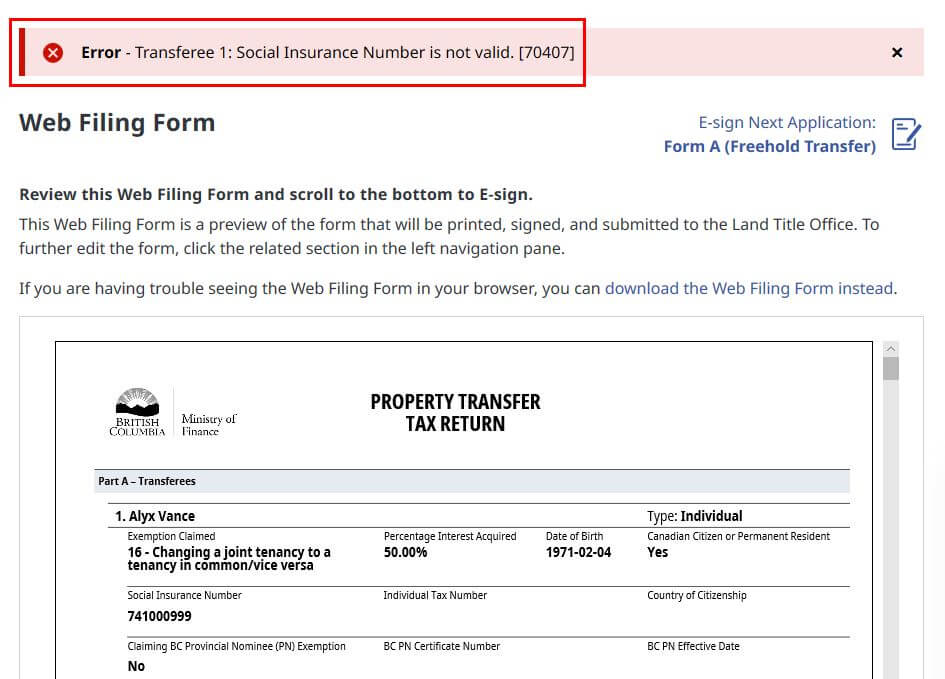

If validation errors are found, edit the form by navigating to the section where the error is. See Edit a Form Within a Package

Review your completed PTT webform. Click Download to obtain a copy (PDF format) for printing and signing.

The completed webform can be downloaded by clicking the download the Web Filing Form instead link. This is in case there are issues viewing it on your browser

The Download button at the bottom left of the webform performs the same way