On This Page

A Web Filing form must be completed and electronically signed online using a LTSA Enterprise account and in compliance with the directions provided in this guide.

General Guidance to Prepare and Submit a Web Filing Form

After you login to your account and create a package, you can start an application. Three key steps to prepare and submit a web filing form are outlined below.

- Complete the data entry sections to create a web filing form

- Review, print, execute and e-sign the form in compliance with the statutory requirements of Land Title Act Part 10.1

- Click Submit Package to submit the package immediately to the land title office or click Prepare Submission in EFS to send your package to EFS where you can add files (PDF or web form) or defer a submission

The content in this guide sets out practice requirements and guidance for completing each data entry section in a web filing form. It does not provide step-by-step instruction of the functional components in the data entry sections (i.e. features and functions of buttons and menus on the page). To learn about the functional components of the page, please see Web Filing in LTSA System Help.

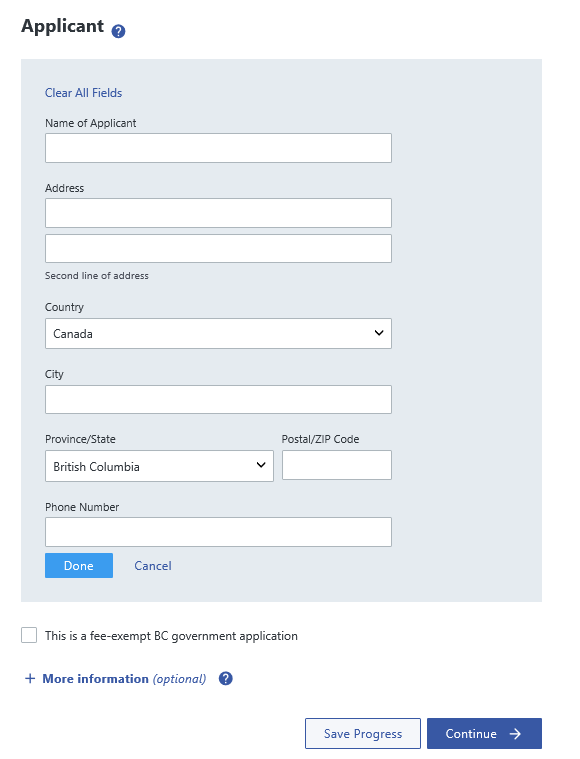

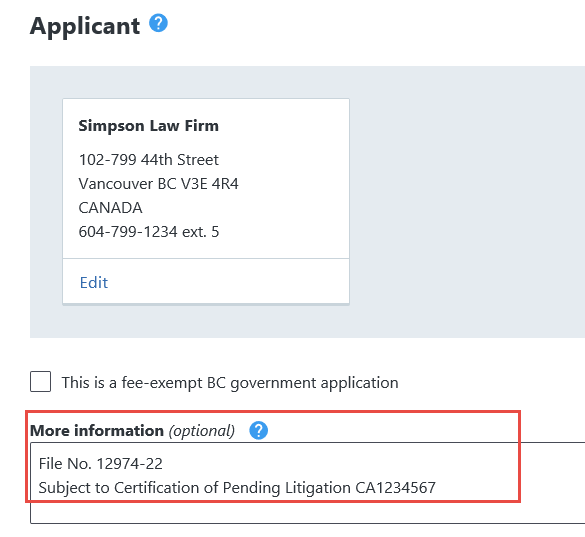

| 1 | Complete the name, address, phone number and (optional) more information.

|

| 1.2 | Under the Land Title Act, the applicant is the person who is entitled to be the registered owner of the estate or interest in land transferred. The applicant section on the web filing form constitutes the application to register the estate or interest in land transferred and must be completed by the applicant or the solicitor or agent of the applicant either before or after execution of the instrument. |

| 1.3 | If the transferee is exempt from land title office fees, select the fee-exempt checkbox. The application must be made on behalf of a ministry (name the ministry) and the ministry file must be referenced in the additional information field. |

| 1.4 | All notices (e.g. notice of receipt, notice declining to register) are sent electronically to the person who submitted the application. |

| 1.5 | Upon submission of a Freehold Transfer to the land title office, a separate application is not necessary unless the transfer also contains an exception, reservation, or condition in favour of or for the benefit of the transferor that is an interest in land capable of registration under the Land Title Act, in which case the transferor must apply to register that interest using a Form 17. |

| 1.6 | If, at the time the transfer is executed, it is intended to register the applicants title subject to a certificate of pending litigation under s. 216(2)(a) or a caveat under s. 288(2) of the Land Title Act, the appropriate written statement may be made in the additional information field.

|

| 1.7 | The land title office will not examine “subject to” provisions or verify them against the state of the title unless the “subject to” provision pertains to certificates of pending litigation or a caveat. |

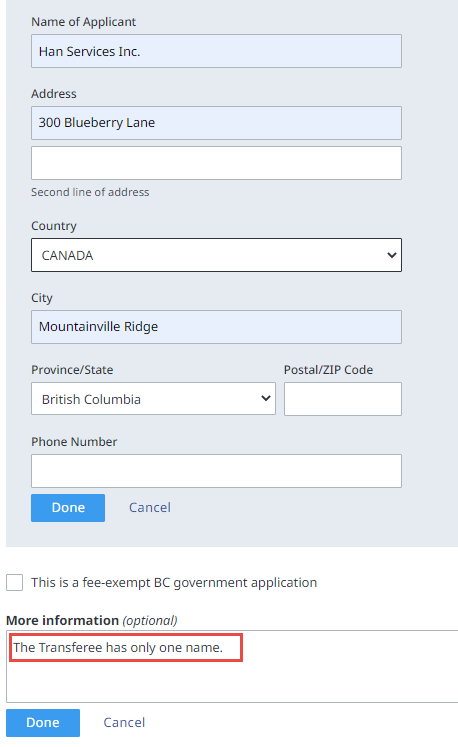

| 1.8 | In cases where a transferee has only one name, open the More information field and enter “the transferee has only one name”. See paragraph 4.11 for guidance on completing Transferee Name fields when the transferee has only one name.

|

| 1.9 | When a pre-existing registered owner is acquiring all or part of a co-owner’s interest in land, the applicant may include the phrase “merge title” in the Additional Information field. This ensures the title is merged during registration, helping to reduce duplication in the records. The registrar may still proceed with a merger even if the phrase is not included as titles held by the same registered owner are subject to consolidation. |

back to top of Freehold Transfer (Form A)

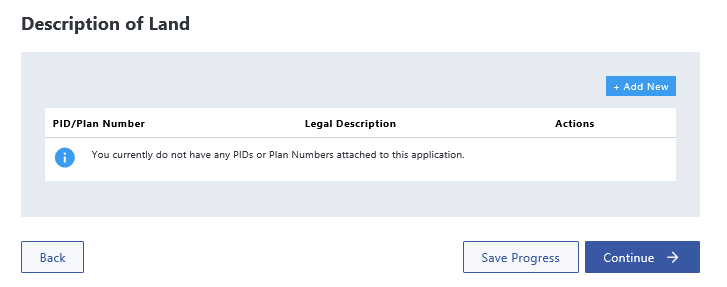

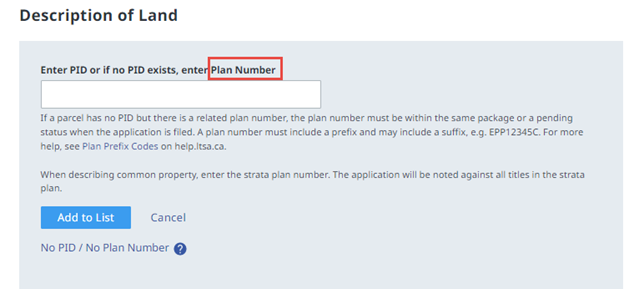

| 2.1 | Complete the PID/Plan Number and Legal Description associated with the parcel.

| ||||||||||||||||||||||||||

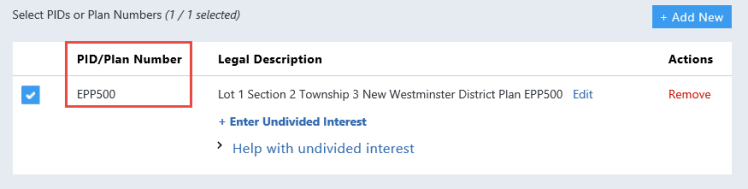

| 2.2 | If entering a related plan number, enter the plan number in the PID or Plan Number field.

| ||||||||||||||||||||||||||

| 2.3 | If a parcel has no PID but there is a related plan number, the plan number must be in the same package or have a pending status when the Form A is submitted. The application is noted against all the registered titles affected by the related plan number.

| ||||||||||||||||||||||||||

| 2.4 | A PID number cannot be duplicated in a single document and a related plan number must be accompanied by a plan application with a PID number and registered title to ensure acceptance in the electronic filing system. | ||||||||||||||||||||||||||

| 2.5 | If a parcel of land is to be subdivided and there are conveyances that relate to each of the new lots within the subdivision plan, enter the parent PID number or relate the application to the subdivision plan number in the same package as the Form A. | ||||||||||||||||||||||||||

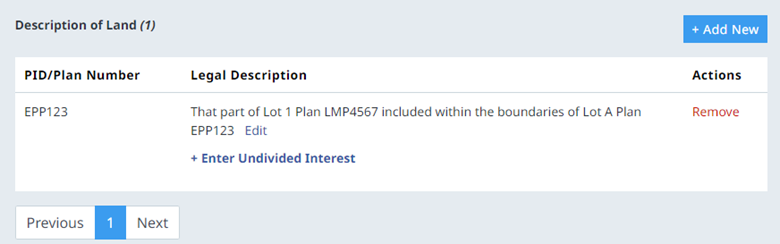

| 2.6 | For a pre-plan conveyance with a related plan number in the same package as the Form A, enter the subdivision plan number in the plan field and include both legal descriptions of the parent parcel and the new parcel as described in the below example.

| ||||||||||||||||||||||||||

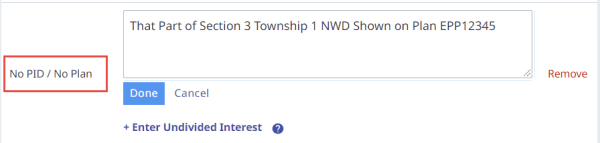

| 2.7 | In limited circumstances, neither a PID number or related plan number is required if the Form A is a transfer of an unregistered parcel and it is submitted in the same package as a Form 17 Fee Simple with one of the following natures of interest:

| ||||||||||||||||||||||||||

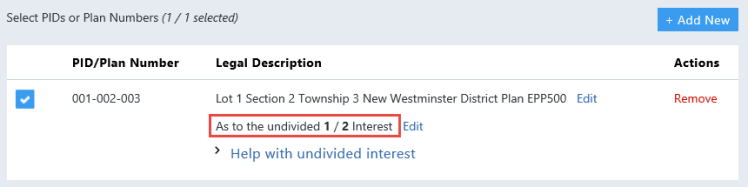

| 2.8 | If less than the entire interest is being transferred, you must set out the fractional interest being transferred.

| ||||||||||||||||||||||||||

| 2.9 | The undivided interest must be a fraction of the whole interest being transferred. For example:

| ||||||||||||||||||||||||||

| 2.10 | To determine the undivided interest transferred, identify what fraction of the whole is being transferred. | ||||||||||||||||||||||||||

| 2.11 | When entering a plan number, you must enter a legal description. The e-filing system will reject your application if no legal description is entered. The following legal description abbreviations are acceptable:

| ||||||||||||||||||||||||||

| 2.12 | When manually entering legal descriptions, extraneous information such as preambles; references to an owner’s share in the common property; water; assessment; improvement district; or legal notations must not be included. | ||||||||||||||||||||||||||

| 2.13 | Any qualifications or exceptions under s. 186(2) of the Land Title Act may be set out in the legal description. | ||||||||||||||||||||||||||

| 2.14 | If you select STC, the order will be sent electronically to the submitter’s LTSA Account Inbox. |

back to top of Freehold Transfer (Form A)

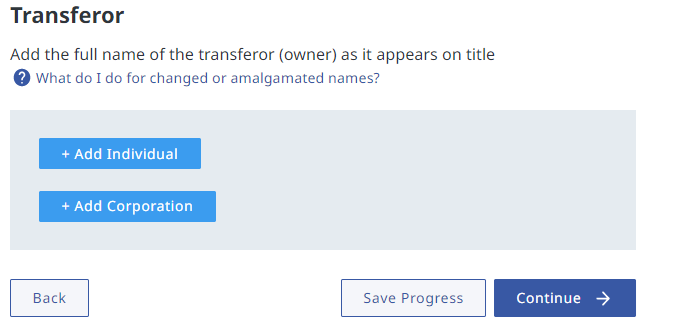

| 3.1 | Complete the full name of the transferor (owner of title) as it appears on title |

| 3.2 | In the case of a corporation, enter its British Columbia incorporation number or registration number, if any.

|

| 3.3 | In the case of a corporation that has changed its name or amalgamated since taking title, enter New Name formerly known as Old Name. e.g. ABC Moving Limited formerly known as Abe’s Moving Limited |

| 3.4 | In the case of a corporation that is neither incorporated or registered in British Columbia, the name of its governing jurisdiction may be entered. |

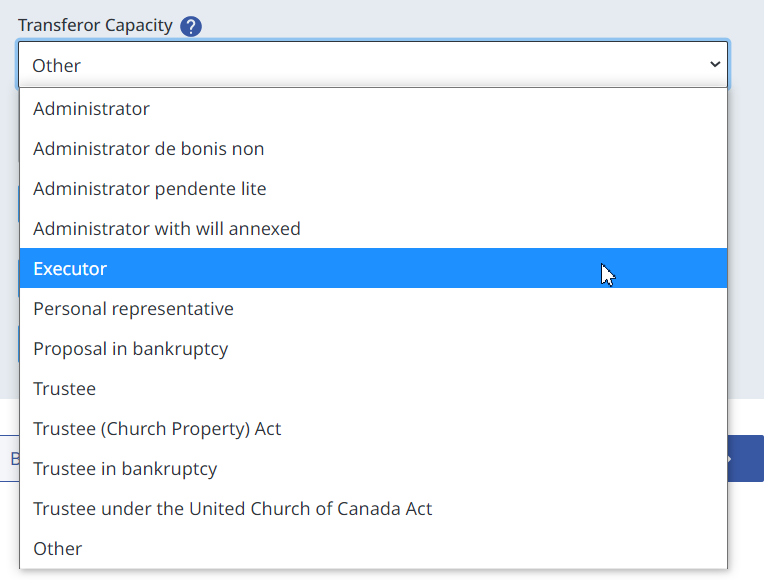

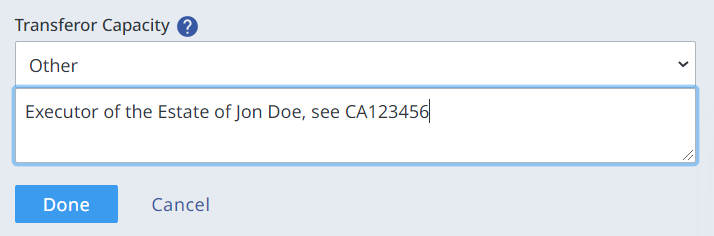

| 3.5 | Complete the Capacity field if applicable.

|

| 3.6 | If a capacity is selected and text is entered in the field, the menu selection will automatically change to Other. The Capacity field will retain the text already entered and additional text can be added if needed.

|

back to top of Freehold Transfer (Form A)

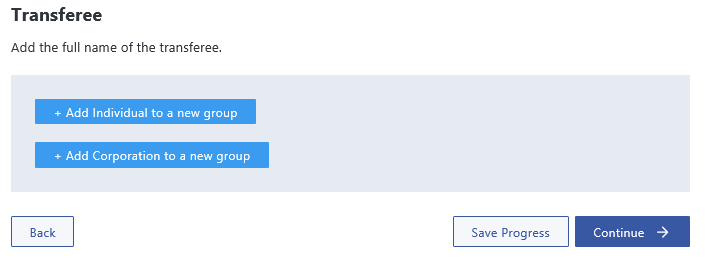

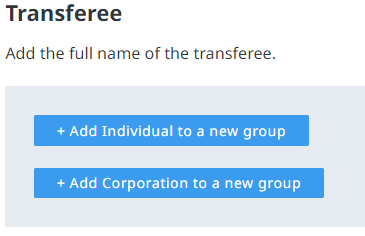

| 4.1 | Complete the full name, address, occupation and incorporation number (applicable to corporation) of the Transferee.

| ||||

| 4.2 | A city, town, or village by itself is not a sufficient postal address. The address must contain a street or route number, post office box number, or general delivery designation as required by Canada Post. In all cases, the postal address must include a postal code. | ||||

| 4.3 | If the corporation is neither incorporated or registered in British Columbia nor incorporated federally, enter the corporation’s name and attach proof of its incorporation to a Form Declaration, e.g., certificate of status. A certificate of status is acceptable for six months from its date of issue. For more detail, see Land Title Practice Manual para. 65.27. | ||||

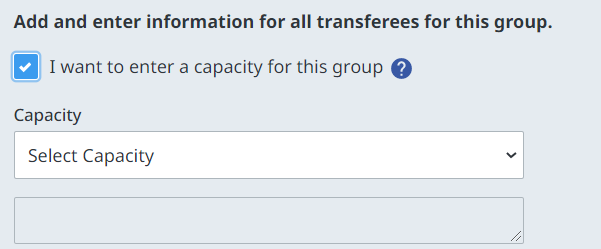

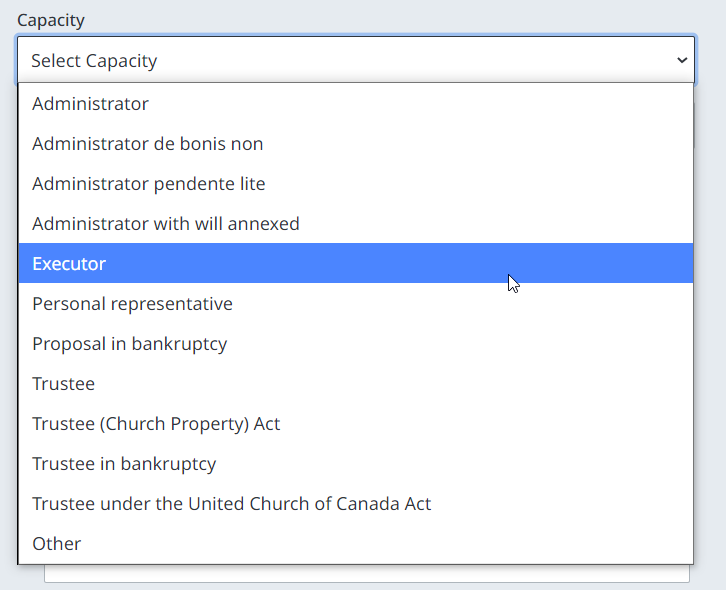

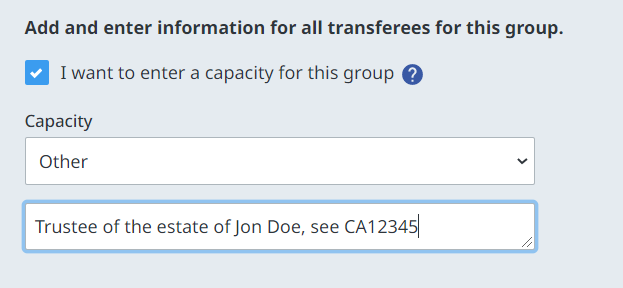

| 4.4 | If the transferee is to hold the interest in a representative capacity, the capacity must be entered in the Capacity field.

| ||||

| 4.5 | If a capacity is selected and text is entered in the field, the menu selection will automatically change to Other. The Capacity field will retain the text already entered and additional text can be added if needed.

| ||||

| 4.6 | Additional information such as references to branch offices or other descriptive information must not be included in the name field. This information may be included in the street address if space accommodates. | ||||

| 4.7 | No proof of incorporation is required for corporations incorporated in British Columbia or federally. For all corporations incorporated in other jurisdictions, proof of incorporation must be attached to a Form Declaration and submitted with the application. | ||||

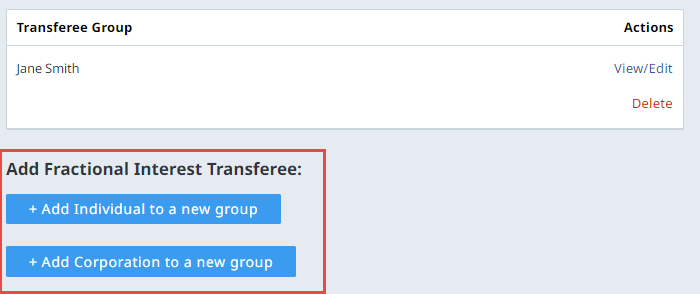

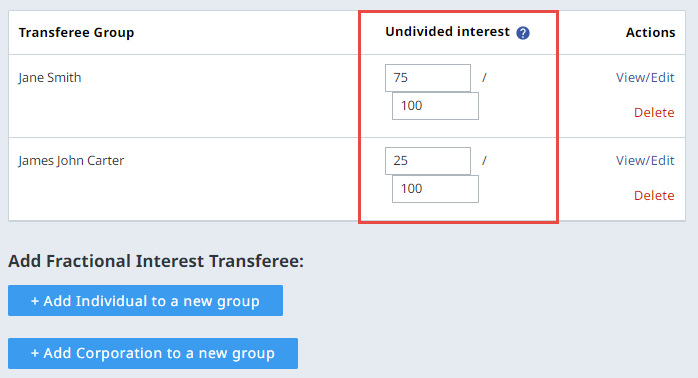

| 4.8 | When transferees are taking ownership as unequal fractional interests, you must set out the transferees respective interest. The interest must total 1. | ||||

| 4.9 | You can create fractional interest groups by first creating a new group and then clicking the Add Fractional Interest Transferee to create another group where you can set out unequal fractional interests.

| ||||

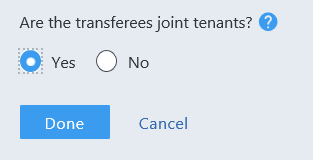

| 4.10 | When transferees are taking ownership as joint tenants, you must select Yes to establish joint tenancy.

| ||||

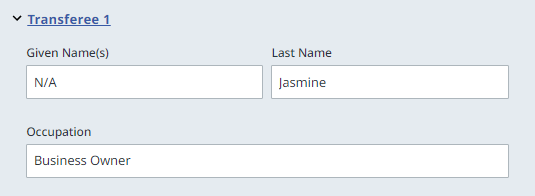

| 4.11 | In cases where a transferee has only one name

The electronic filing system will reject the application if the Given Name or Last Name field is empty. When completing the Occupation field for a transferee, limit the entry to 50 characters or fewer. | ||||

| 4.12 | Although the Web Filing Form may allow longer entries, the LTSA’s internal registration system imposes a maximum limit of 50 characters. Occupations that exceed this limit may result in processing delays. |

back to top of Freehold Transfer (Form A)

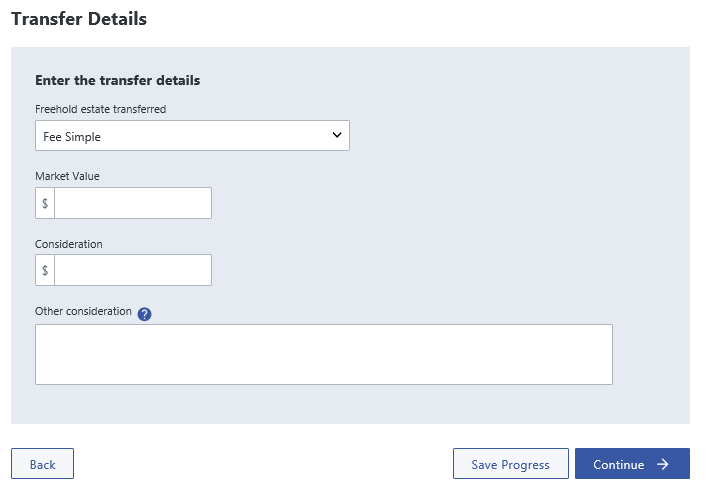

| 5.1 | Complete the type of freehold estate, market value and consideration.

| ||||||||

| 5.2 | Section 186(4) to (8) of the Land Title Act contemplates four categories of freehold estate, namely:

| ||||||||

| 5.3 | A Fee Simple estate operates to transfer the estate of the transferor without any words of transfer or limitation under section 186(4) of the Land Title Act. | ||||||||

| 5.4 | In the case of a life estate, select For the Life of the Transferee. If the life estate includes terms and conditions, attach the terms and conditions to a Form Declaration and include the Form Declaration in support of the Form A application. | ||||||||

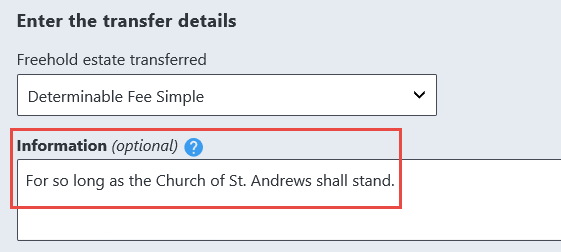

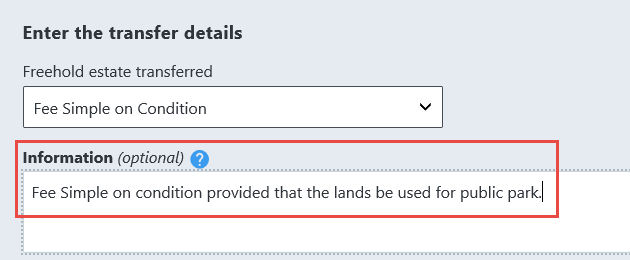

| 5.5 | For a Determinable Fee Simple or Fee Simple on Condition, enter the appropriate text creating the limitation in the Information field.

| ||||||||

| 5.6 | When a Determinable Fee Simple or Fee Simple on Condition is submitted for registration, the application must be accompanied by an application for a Possibility of Reverter or a Right of Entry – both on the Form 17 Charge, Notation or Filing. | ||||||||

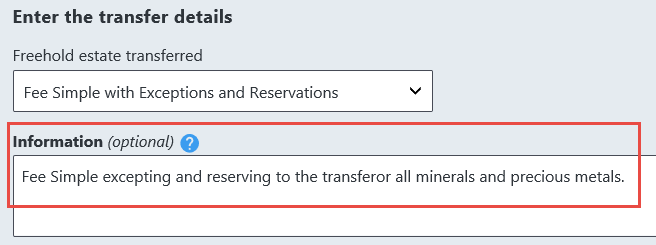

| 5.7 | A Fee Simple with Exceptions and Reservations operates to qualify the nature of the freehold passing. Enter the exceptions and/or reservation from the grant in the Information field.

| ||||||||

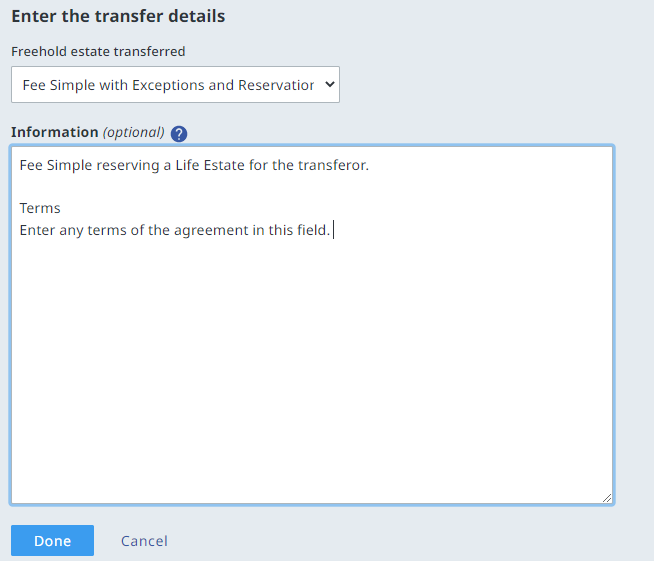

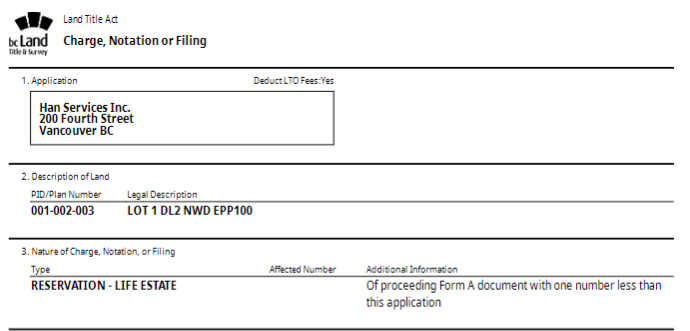

| 5.8 | A Fee Simple with Exceptions and Reservations must be used to create a reservation of a life estate. In the Information field, enter the language to indicate the reservation of the life estate and any terms of the agreement. A separate Form 17 Charge must accompany the Form A reserving the life estate. On the Form 17 select Reservation – Life Estate. No attachment is required.

| ||||||||

| 5.9 | Rights or interests reserved to the transferor must be capable of registration as a charge and the transferor must apply concurrently in Form 17 for registration under s. 181 of the Land Title Act. | ||||||||

| 5.10 | The market value must be stated whether or not it is the same amount as the consideration. | ||||||||

| 5.11 | Where applicable, the market value can reflect the market value of the fractional interest of the lands being transferred. | ||||||||

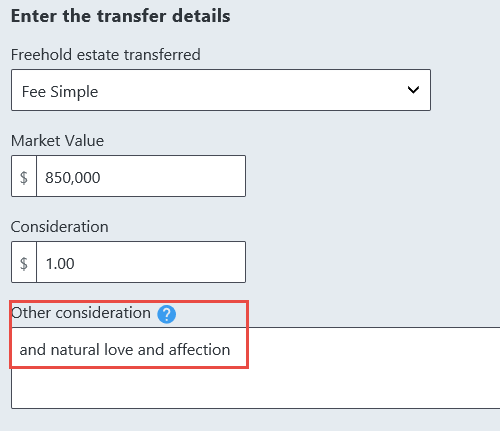

| 5.12 | A consideration must be expressed in figures or by description. If the consideration is non-monetary, enter a description of the consideration in the Other consideration field. The expression “…and other good and valuable consideration is not a sufficient description”.

|

back to top of Freehold Transfer (Form A)

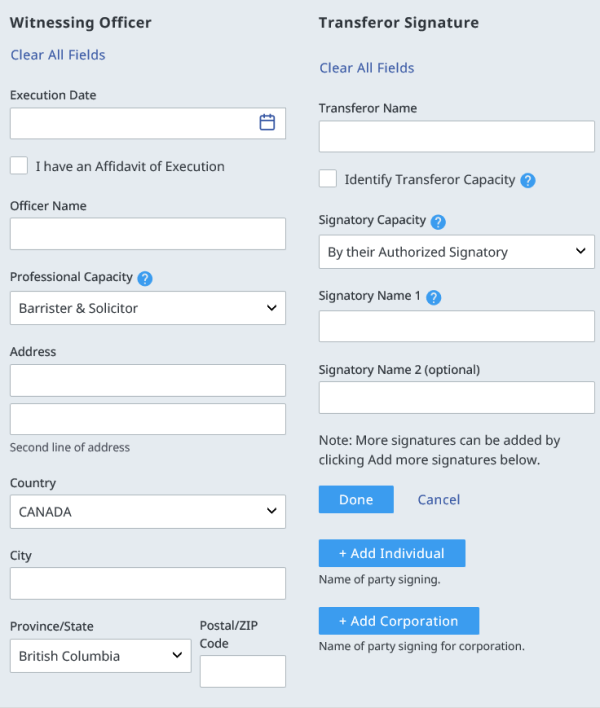

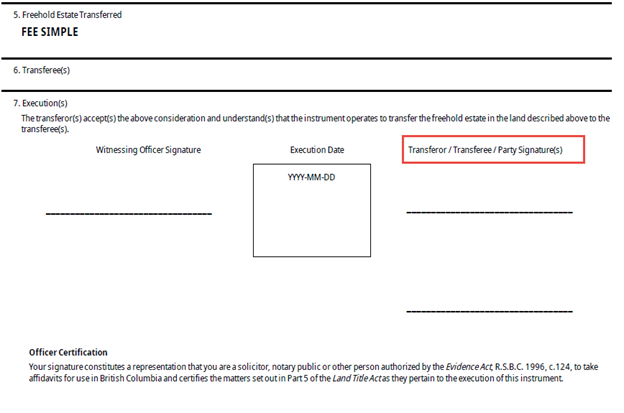

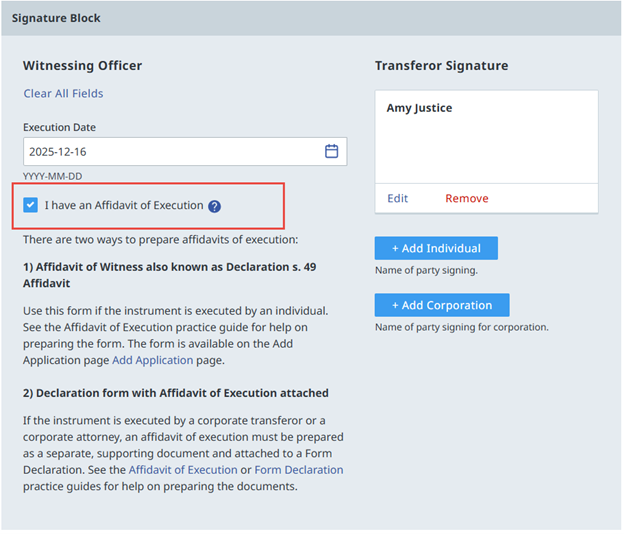

| 6.1 | Complete the execution details for the witnessing officer, execution date and transferor.

|

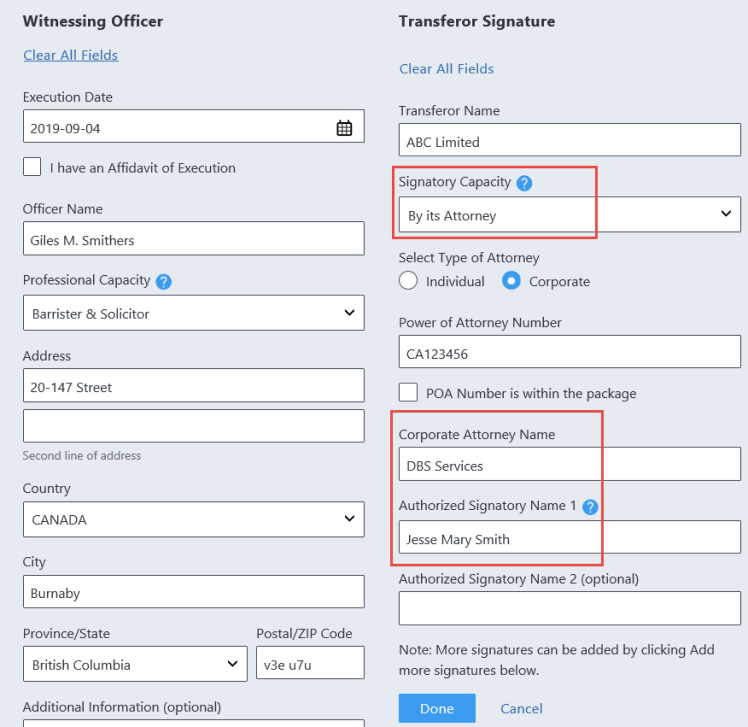

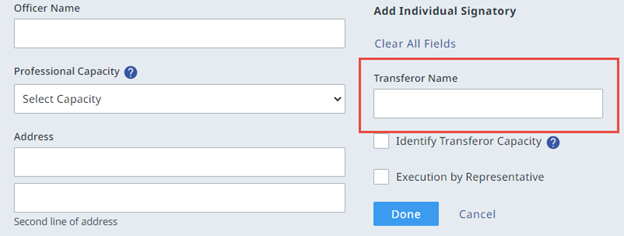

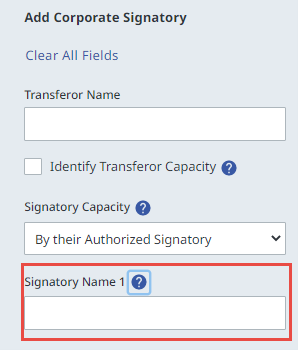

| 6.2 | In the case of a transfer executed by a corporation, ensure that the name of the authorized signatory is entered in the Signatory Name field.

|

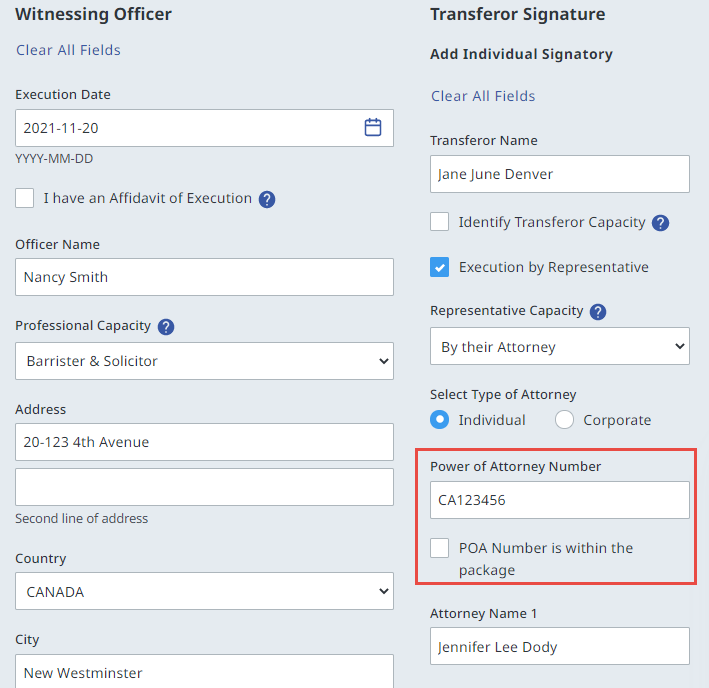

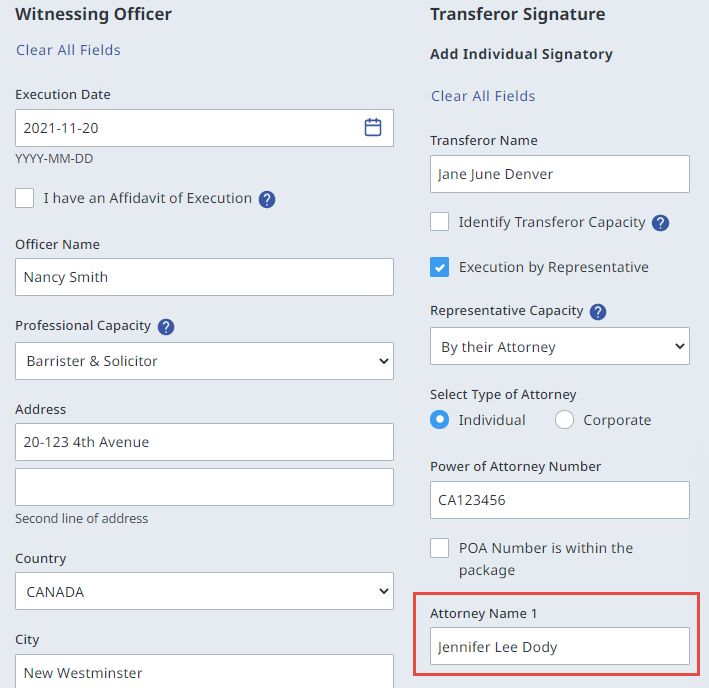

| 6.3 | In the case of a transfer executed by an attorney, enter the power of attorney number if it is already filed in the land title office. If it is not filed in the land title office, the power of attorney must be included in the same package as the transfer.

|

| 6.4 | In the case of a transfer executed by a corporate attorney, it must be clear that the signatory is an authorized signatory of the corporate attorney and that the corporate attorney is acting as the attorney for the transferor.

|

| 6.5 | For applications executed by an attorney or other representative, complete the attorney name or signatory name.

|

| 6.6 | The execution details can be completed after the form is printed and executed. See the Practice Note on truing up (editing) an original electronic instrument. |

| 6.7 | When you generate the web filing form, the execution section provides Transferee / Party Signature(s) as signature options.

|

| 6.8 | When truing up the electronic instrument, you can add a Transferee / Party Signature in the Transferor Name or Corporate Signatory Name fields.

|

| 6.9 | The definition of an officer is limited to a person before whom an affidavit may be sworn under the Evidence Act, R.S.B.C 1996, c. 124, ss. 60, 63, and 64. |

| 6.10 | The officer signature must appear directly opposite the transferor signature certified by the officer. If an officer is certifying more than one transferor signature, add “as to all signatures” or “as to the signatures of…” to the form and when truing up the instrument add it to the Additional Information field. |

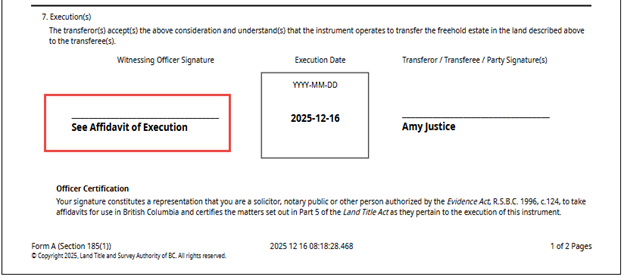

| 6.11 | If the signature of the transferor is not witnessed in the manner required by Part 5 of the Land Title Act, the registrar may accept an affidavit of execution if it meets the requirements set out in section 49 of the Land Title Act. In web filing select “I have an Affidavit of Execution” in the execution data entry section of the form. When the form is generated, “See Affidavit of Execution” automatically appears in the officer signature field.

|

| 6.12 | If completing by Affidavit of Execution, the affidavit must state the reason an officer certification cannot be obtained. The reason must be sufficient for the registrar to accept the affidavit in lieu of an officer certification. In cases, where affidavit evidence of execution is submitted, the registrar is not likely to exercise discretion unless office certification is simply impossible to obtain under the circumstances or the transfer was executed outside British Columbia. |

| 6.13 | In cases where the freehold estate transfer document is executed outside British Columbia, the registrar will accept that it is difficult to obtain officer certification in all cases and will accept an affidavit of execution in lieu of officer certification. |

| 6.14 | The preferred forms of affidavit are intended to provide guidelines only. Changes to the wording may be acceptable. |

back to top of Freehold Transfer (Form A)

| 7.1 | Informational documents are not a requirement when filing a Form A. |

| 7.2 | To request a delay in sending a Notice Declining to Register in order to file a release of a Land Tax Deferment Act charge, select statement type Land Tax Deferment Letter Consent from the dropdown list on a Declaration form. Do not attach a separate letter (requesting the delay) to a Form A or Declaration form. See the Declaration Practice Guide, Section 4.6 for more on describing a “Land Tax Deferment Act Declaration”. |

| 7.3 | Any supporting document required to be filed with a Form A must be attached to a Declaration form. |

back to top of Freehold Transfer (Form A)

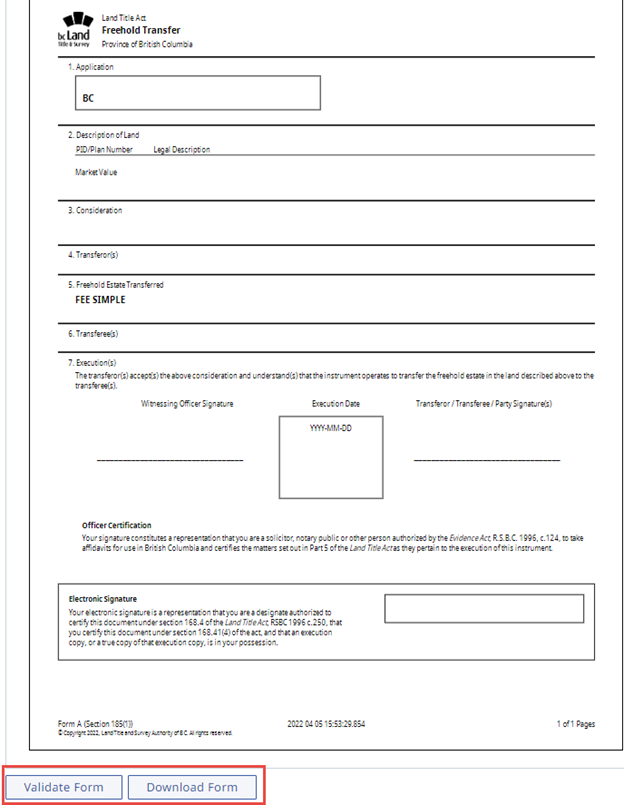

| 8.1 | After completing the data entry sections, see a preview of the web filing form. You can review, validate, download and e-sign on this page.

|

| 8.2 | Once the web filing form is complete, the document must be printed and executed in accordance with Part 5 of the Land Title Act Stay in compliance with Land Title Act, Part 10.1 and the Quality Verification Program. Ensure the timestamp on the execution copy is identical to the timestamp on the web filing form before submitting your package to the land title office. |

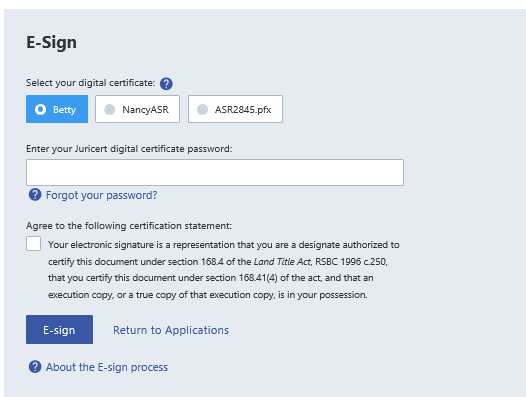

| 8.3 | A British Columbia lawyer or notary must e-sign the form before it can be submitted. The electronic signature certifies that the designate has in their possession an execution copy or a true copy of that execution copy. |

| 8.4 | Once the form is e-signed, it cannot be modified in any way without invalidating the electronic signature. |

| 8.5 | To e-sign a web filing form, you must install your digital certificate on an LTSA Account. |