On This Page

A Web Filing form must be completed and electronically signed online using a LTSA Enterprise account and in compliance with the directions provided in this guide.

General Guidance to Prepare and Submit a Web Filing Form

After you login to your account and create a package, you can start an application. Three key steps to prepare and submit a web filing form are outlined below.

- Complete the data entry sections to create a web filing form

- Review, print and e-sign the form in compliance with the statutory requirements of Land Title Act Part 10.1

- Click Submit Package to submit the package immediately to the land title office or click Prepare Submission to send your package to EFS where you can add files or defer a submission

The content in this guide sets out practice requirements and guidance for completing each data entry section in a web filing form. It does not provide step-by-step instruction of the functional components in the data entry sections (i.e. features and functions of buttons and menus on the page). To learn about the functional components of the page, please see Web Filing in LTSA System Help .

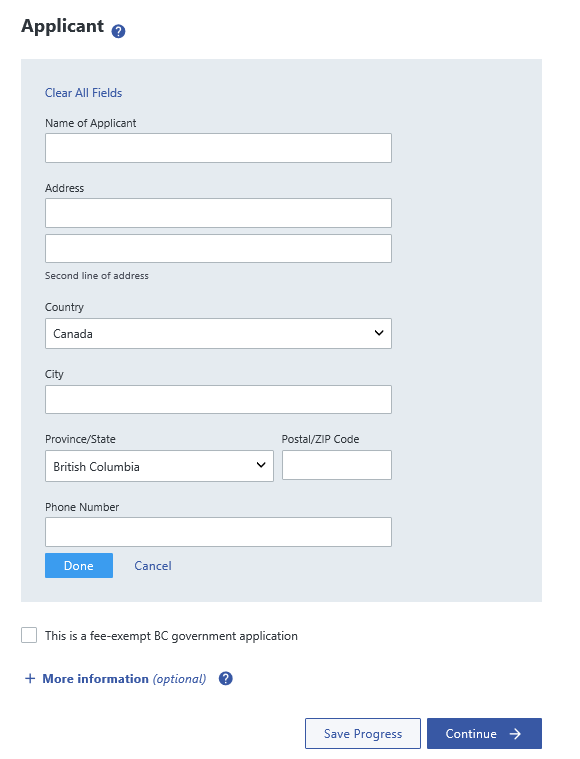

| 1.1 |

Complete the name, address, phone number and (optional) more information.

|

| 1.2 | Under the Land Title Act, the applicant is the person who is entitled to be the registered owner of the estate or interest in land transferred. The applicant section on the web filing form constitutes the application to register the estate or interest in land transferred and must be completed by the applicant or the solicitor or agent of the applicant either before or after execution of the instrument. |

| 1.3 | If the transferee is exempt from land title office fees, select the fee-exempt checkbox. The application must be made on behalf of a ministry (name the ministry) and the ministry file must be referenced in the additional information field. |

| 1.4 | All notices (e.g. notice of receipt, notice declining to register) are sent electronically to the person who submitted the application. |

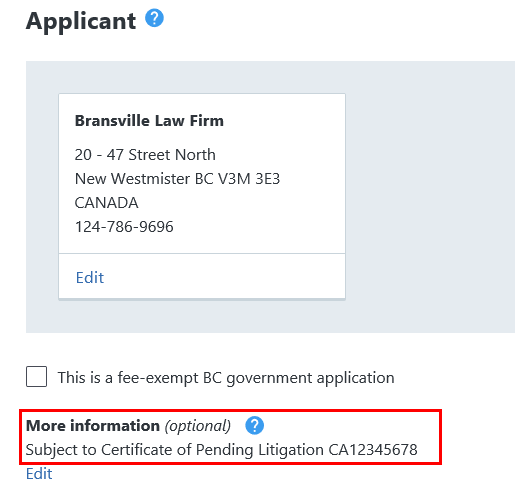

| 1.5 |

If, at the time the application is submitted, it is intended to register the applicants title subject to a certificate of pending litigation under section 216(2)(a) or a caveat under section 288(2) of the Land Title Act, the appropriate written statement may be made in the additional information field.

|

| 1.6 | The land title office will not examine “subject to” provisions or verify them against the state of the title unless the “subject to” provision pertains to certificates of pending litigation or a caveat. |

back to top of Form 17 (Fee Simple)

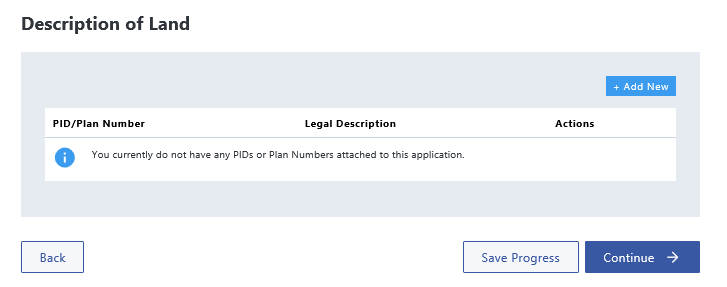

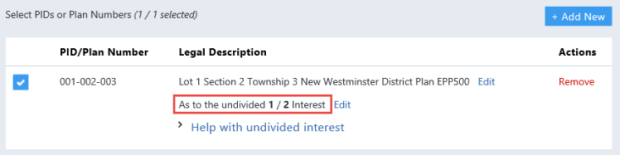

| 2.1 |

Complete the PID or Plan Number and Legal Description associated with the parcel.

|

|||||||||||||||||||||||||||

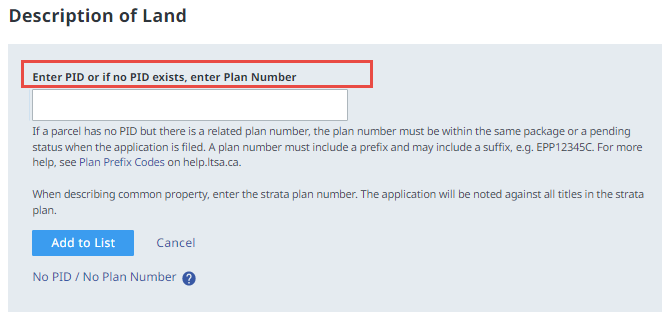

| 2.2 |

If entering a related plan number, enter the plan number in the PID or Plan Number field.

|

|||||||||||||||||||||||||||

| 2.3 |

If a parcel has no PID but there is a related plan number, the plan number must be in the same package or have a pending status when the Form 17 is submitted. The application is noted against all the registered titles affected by the related plan number.

|

|||||||||||||||||||||||||||

| 2.4 |

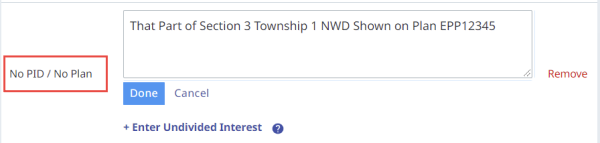

In limited circumstances, neither a PID number or related plan number is required if the application is a transfer of an unregistered parcel and it is submitted in the same package as a Form 17 Fee Simple with one of the following natures of interest:

|

|||||||||||||||||||||||||||

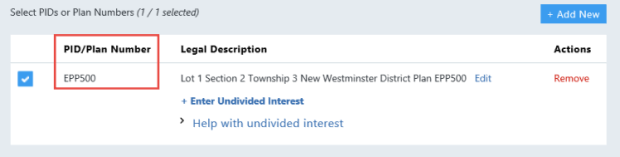

| 2.5 |

If less than the entire is being transferred, you must set out the fractional interest being transferred.

|

|||||||||||||||||||||||||||

| 2.6 |

The undivided interest must be a fraction of the whole interest being transferred. For example:

|

|||||||||||||||||||||||||||

| 2.7 | To determine the undivided interest transferred, identify what fraction of the whole is being transferred. | |||||||||||||||||||||||||||

| 2.8 | Any qualifications or exceptions under s. 186(2) of the Land Title Act may be set out in the legal description. | |||||||||||||||||||||||||||

| 2.9 | When entering a plan number, you must enter a legal description. The e-filing system will reject your application if no legal description is entered. | |||||||||||||||||||||||||||

| 2.10 |

The following legal description abbreviations are acceptable:

|

|||||||||||||||||||||||||||

| 2.11 | When manually entering legal descriptions, extraneous information such as preambles; references to an owner’s share in the common property; water; assessment; improvement district; or legal notations must not be included. | |||||||||||||||||||||||||||

| 2.12 | If you select STC, the order will be sent electronically to the submitter’s LTSA Account Inbox. |

back to top of Form 17 (Fee Simple)

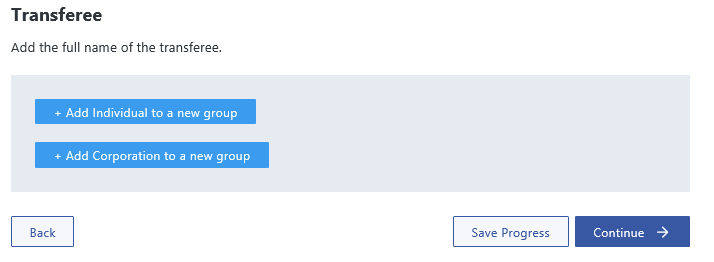

| 3.1 |

Complete the full name, address, occupation and incorporation number (applicable to corporation) of the transferee.

|

|

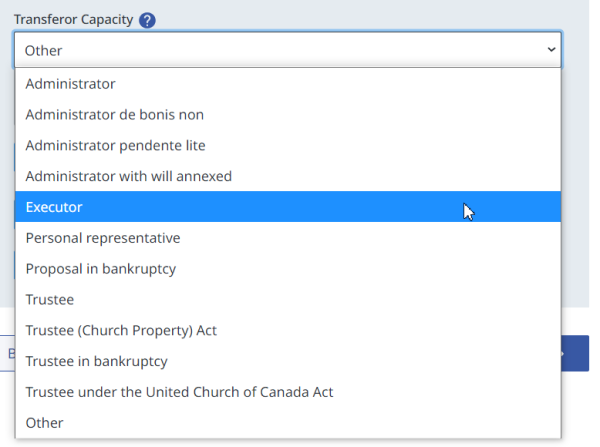

| 3.2 |

If the transferee is to hold the interest in a representative capacity, the capacity must be entered in the Capacity field.

|

|

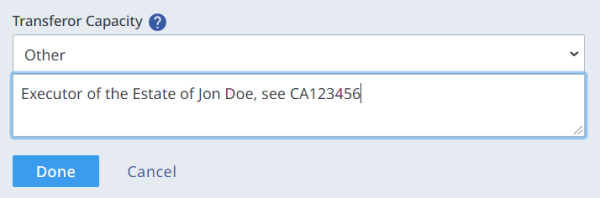

| 3.3 |

If a capacity is selected and text is entered in the field, the menu selection will automatically change to Other. The Capacity field will retain the text already entered and additional text can be added if needed.

|

|

| 3.4 | Additional information such as references to branch offices or other descriptive information must not be included in the name field. This information may be included in the street address if space accommodates. | |

| 3.5 | A city, town, or village by itself is not a sufficient postal address. The address must contain a street or route number, post office box number, or general delivery designation as required by Canada Post. In all cases, the postal address must include a postal code. | |

| 3.6 | If the corporation is neither incorporated or registered in British Columbia nor incorporated federally, enter the corporation’s name and attach proof of its incorporation to a Form Declaration, e.g., certificate of status. A certificate of status is acceptable for six months from its date of issue. For more detail, see Land Title Practice Manual para. 65.27. | |

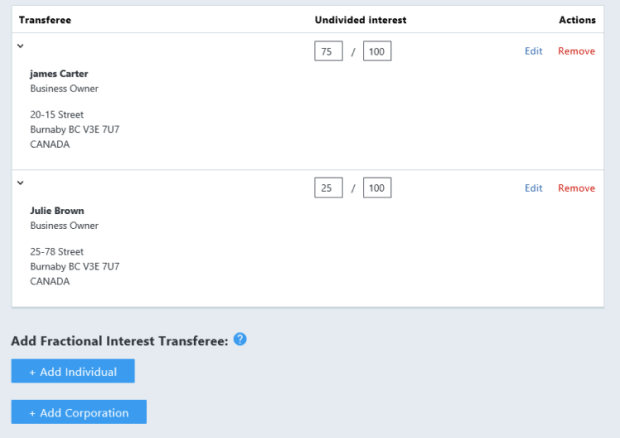

| 3.7 | No proof of incorporation is required for corporations incorporated in British Columbia or federally. | |

| 3.8 |

When transferees are taking ownership as unequal fractional interests, you must set out the transferees respective interest. The interest must total 1.

|

|

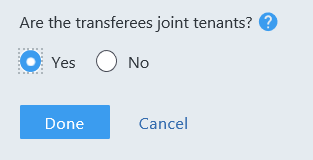

| 3.9 |

When transferees are taking ownership as joint tenants, you must select Yes to establish joint tenancy.

|

back to top of Form 17 (Fee Simple)

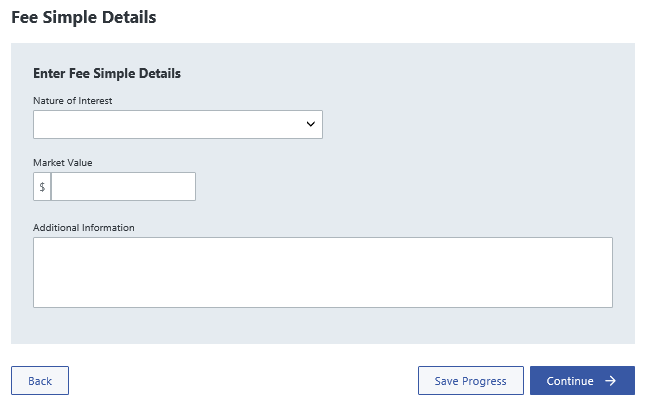

| 4.1 |

Complete the nature of interest for each application.

|

| 4.2 | Complete the market value, if required. The field can be left blank or you may enter $0.00. |

| 4.3 |

When to use nature of interest Amendment to Title Owner An amendment to title owner name is used in cases where the applicant submitted an application with an error in an owner’s name and the application was registered. An applicant can apply to have the owner’s name corrected. The application must include a statutory declaration from any party who is knowledgeable of the facts. Circumstances for each application will vary and the statement of facts must describe the error in the name, state what the true and legal name is, along with any other statements relevant to the circumstances of the application. If the amendment is to add or remove a name, a certificate issued by the appropriate government authority is required, e.g., vital statistics. |

| 4.4 |

When to use nature of interest Change of Name A change of name is used in cases where the owner is requesting a lawful change of name due to marriage, divorce, or formal change of name. The application must include legal documents supporting all name changes in the form of certificates issued by the appropriate government authority and if applicable, a statutory declaration explaining any discrepancies. |

back to top of Form 17 (Fee Simple)

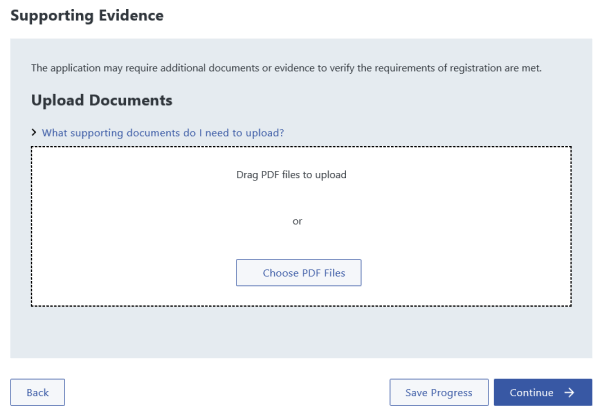

| 5.1 |

Upload the required supporting document for the application.

|

| 5.2 | The supporting documents that may be submitted in conjunction with a Form 17 Fee are listed in the Form 17 Help Guide. |

| 5.3 | Where a supporting document is submitted with an electronic application, it must be a scanned image of the document that has been prepared in compliance with the scanning requirements. |

| 5.4 | If a supporting document is in a foreign language, it must be translated in the English language, e.g., birth or death certificate. The translator must be fluent in both English and the foreign language and must complete a statutory declaration confirming the translation is accurate and true |

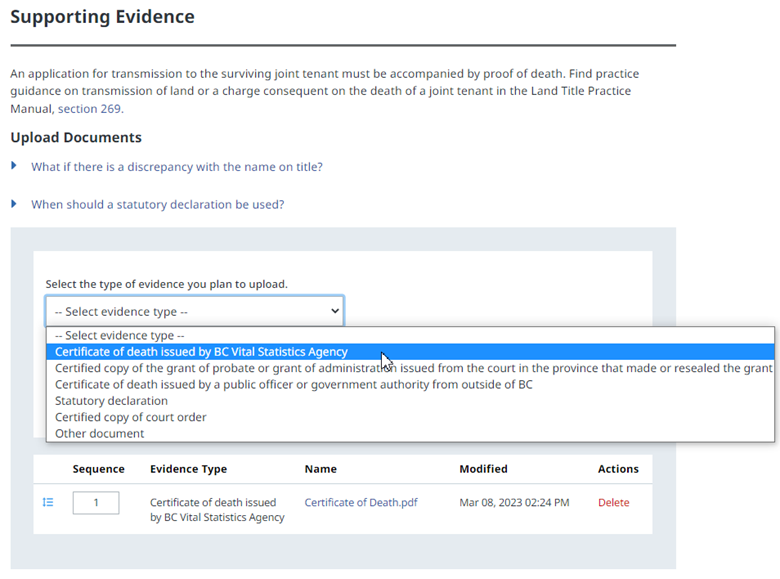

| 5.5 |

In the case of a Transmission to Surviving Joint Tenant, you must select the type of evidence you plan to upload. The page includes a pick list of supporting evidence options. Once you select the type of evidence from the list, the Upload a PDF file is enabled. You can select and upload only one PDF at a time.

|

back to top of Form 17 (Fee Simple)

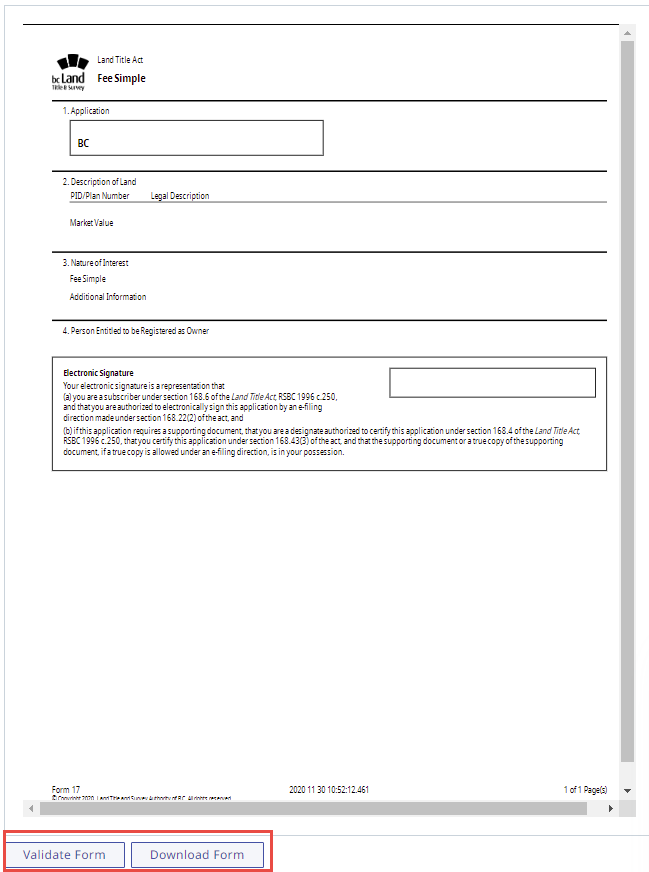

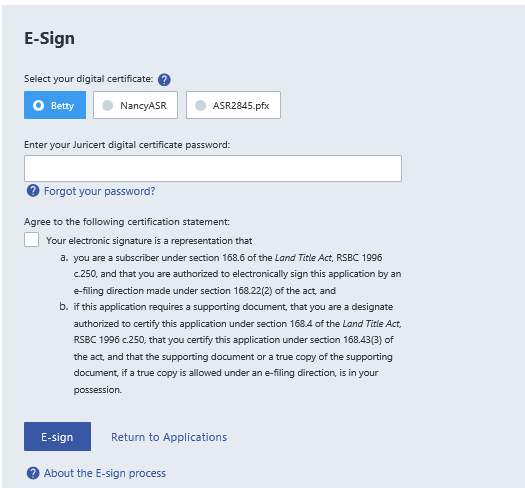

| 6.1 |

After completing the data entry sections and attaching the supporting evidence, see a preview of the web filing form. You can review, validate, download, and e-sign on this page.

|

| 6.2 | A British Columbia lawyer, notary or member of the Authorized Subscriber Register must e-sign the form before it can be submitted. |

| 6.3 | If the application requires a supporting document, electronic signature certifies that the designate has in their possession the supporting document or if the E-filing Direction allows a true copy of that supporting document. |

| 6.4 | Once the form is e-signed, it cannot be modified in any way without invalidating the electronic signature. |

| 6.5 | To e-sign a web filing form, you must install your digital certificate on an LTSA Account. |