On This Page

A Web Filing form must be completed and electronically signed online using a LTSA Enterprise account and in compliance with the directions provided in this guide.

General Guidance to Prepare and Submit a Web Filing Form

After you login to your account and create a package, you can start an application. Three key steps to prepare and submit a web filing form are outlined below.

- Complete the data entry sections to create a web filing form

- Review, print and e-sign the form in compliance with the statutory requirements of Land Title Act Part 10.1

- Click Submit Package to submit the package immediately to the land title office or click Prepare Submission to send your package to EFS where you can add files (PDF or web form) or defer a submission

The content in this guide sets out practice directions and guidance for completing each data entry section in a web filing form. It does not provide step-by-step instruction of the functional components in the data entry sections (i.e. features and functions of buttons and menus on the page). To learn about the functional components of the page, please see Web Filing in LTSA System Help.

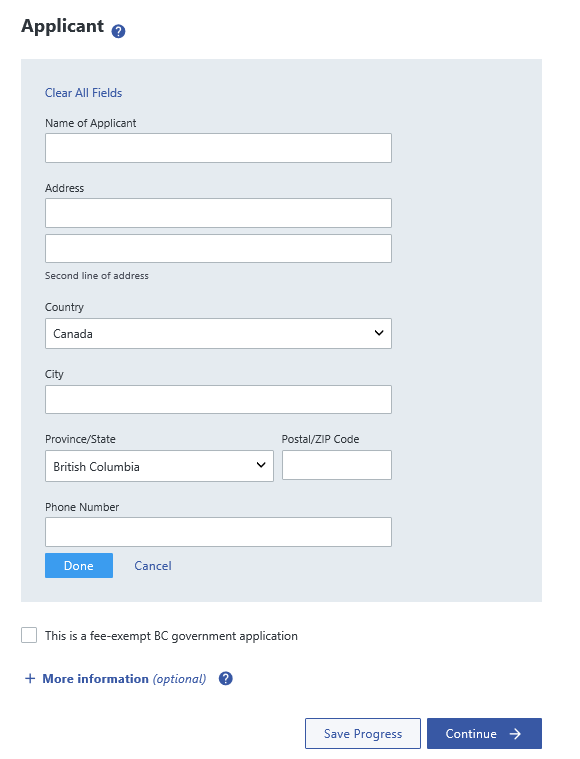

| 1.1 |

Complete the name, address, phone number and (optional) more information.

|

| 1.2 | Under the Land Title Act, the applicant is the person who is entitled to be the registered owner of the estate or interest in land released. The applicant section on the web filing form constitutes the application to register the estate or interest in land released and must be completed by the applicant or the solicitor or agent of the applicant either before or after execution of the instrument. |

| 1.3 | If the transferee is exempt from land title office fees, select the fee-exempt BC government checkbox. The application must be made on behalf of a ministry (name the ministry) and the ministry file must be referenced in the additional information field. |

| 1.4 | All notices (e.g. notice of receipt, notice declining to register) are sent electronically to the person who submitted the application. |

back to top of Form 17 (Cancellation of Charge, Notation or Filing)

Charge, Lien, Interest or Notation

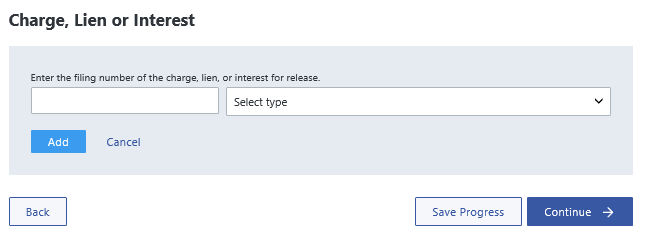

| 2.1 |

Complete the filing number and type of charge, lien, interest or notation.

|

|||||||||||||||||||||||||||

| 2.2 | For a cancellation of a charge by effluxion of time, add a description of the charge to be cancelled in the Add Information field. | |||||||||||||||||||||||||||

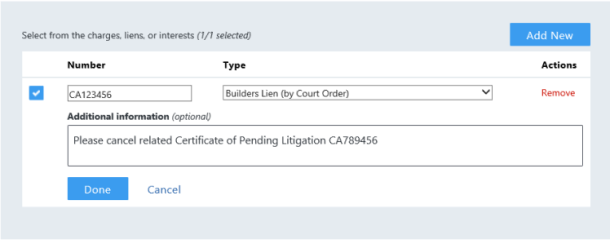

| 2.3 |

The additional information field must be used to apply for cancellation of a (related) certificate of pending litigation when the holder of a Builders Lien (By Court Order) applies for cancellation of the charge.

EFS will reject applications that contain more than one nature of interest for certain charge types. |

|||||||||||||||||||||||||||

| 2.4 |

You will need to create separate applications (one type per form) for the following natures of interest:

|

back to top of Form 17 (Cancellation of Charge, Notation or Filing)

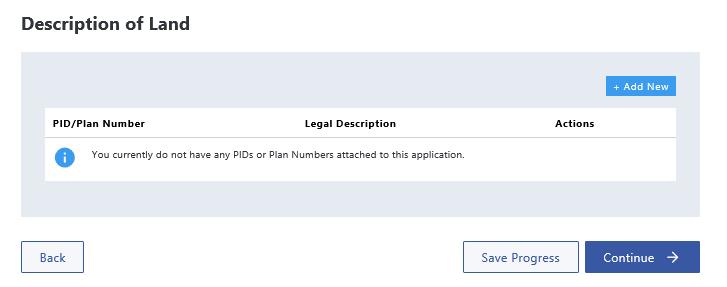

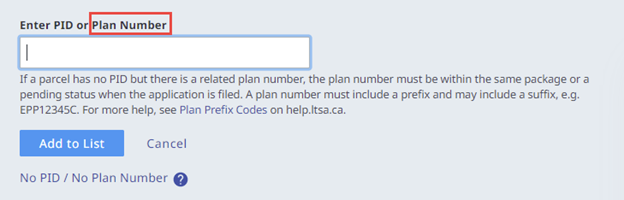

| 3.1 |

Complete the PID or Plan Number and Legal Description associated with the charge, lien, or interest.

|

|||||||||||||||||||||||||||

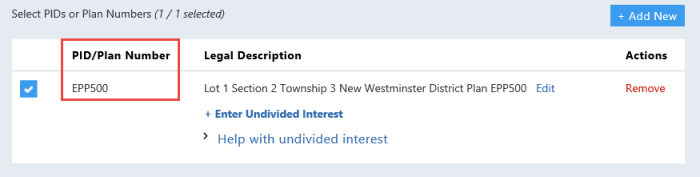

| 3.2 |

If entering a related plan number, enter the plan number in the PID or Plan Number field.

|

|||||||||||||||||||||||||||

| 3.3 |

If a parcel has no PID but there is a related plan number, the plan number must be in the same package or have a pending status when the Form 17 Cancellation is submitted. The application is noted against all the registered titles affected by the related plan number.

|

|||||||||||||||||||||||||||

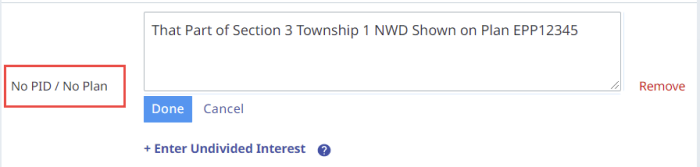

| 3.4 |

In limited circumstances, neither a PID number or related plan number is required if the Form 17 Cancellation affects an unregistered parcel and it is submitted in the same package as a Form 17 Fee Simple with one of the following natures of interest:

|

|||||||||||||||||||||||||||

| 3.5 | When releasing a charge from the common property, enter the strata plan number in the plan number field. The application will be noted against all titles in the strata plan. | |||||||||||||||||||||||||||

| 3.6 |

When entering a plan number, you must enter a legal description. The e-filing system will reject your application if no legal description is entered. The following legal description abbreviations are acceptable:

|

|||||||||||||||||||||||||||

| 3.7 | When manually entering legal descriptions, extraneous information such as preambles; references to an owner’s share in the common property; water; assessment; improvement district; or legal notations must not be included. | |||||||||||||||||||||||||||

| 3.8 | If you select STC, the order will be sent electronically to the submitter’s LTSA Account Inbox. |

back to top of Form 17 (Cancellation of Charge, Notation or Filing)

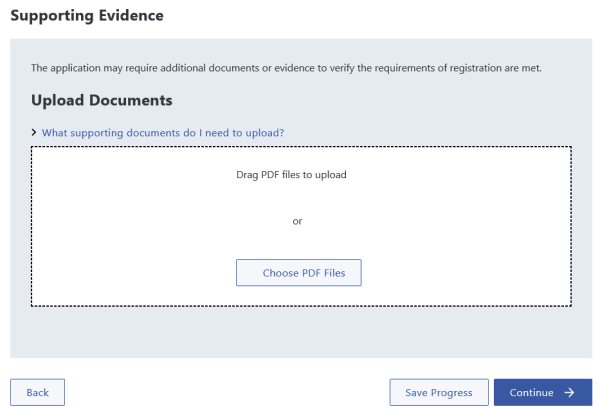

| 4.1 |

Upload the required supporting document for the application.

|

| 4.2 | The supporting documents that may be submitted in conjunction with a Form 17 Cancellation are listed in the Form 17 Help Guide. |

| 4.3 | Where a supporting document is submitted with an electronic application, it must be a scanned image of the document that has been prepared in compliance with the scanning requirements. |

| 4.4 | If a supporting document is in a foreign language, it must be translated in the English language. The translator must be fluent in both English and the foreign language and must complete a statutory declaration confirming the translation is accurate and true. |

back to top of Form 17 (Cancellation of Charge, Notation or Filing)

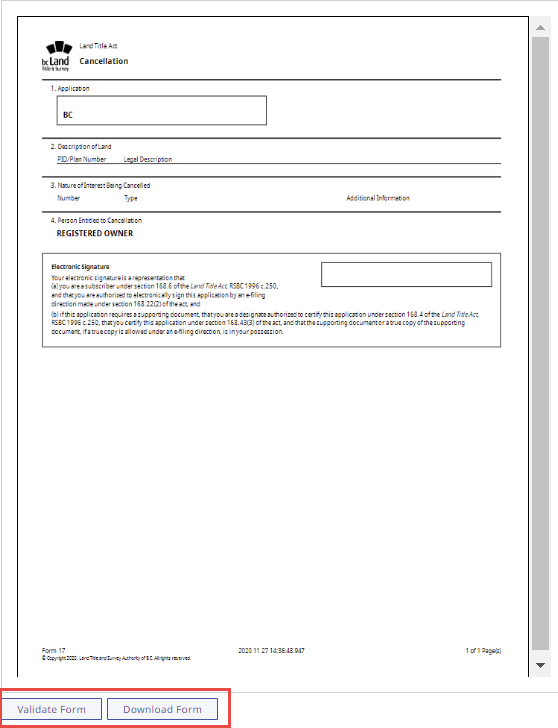

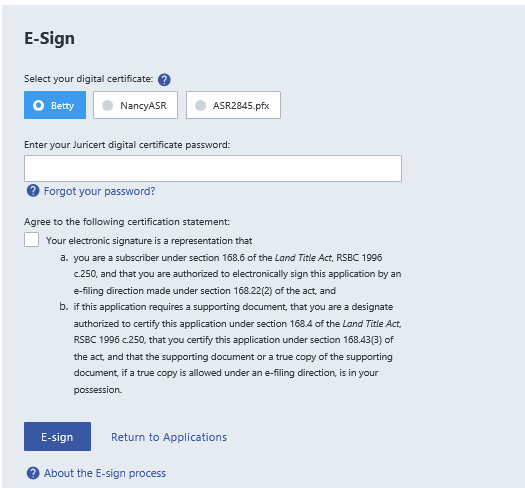

| 5.1 |

After completing the data entry sections, see a preview of the web filing form. You can review, validate, download, and e-sign on this page.

|

| 5.2 | A British Columbia lawyer, notary or member of the Authorized Subscriber Register must e-sign the form before it can be submitted. |

| 5.3 | If the application requires a supporting document, the electronic signature certifies that the designate has in their possession the supporting document or if the E-filing Direction allows a true copy of that supporting document. |

| 5.4 | Once the form is e-signed, it cannot be modified in any way without invalidating the electronic signature. |

back to top of Form 17 (Cancellation of Charge, Notation or Filing)