You must activate your LTSA Enterprise account before you can start searching and filing.

Activating a LTSA Enterprise account is a two-step process.

- Create a deposit account. This is used to fund search and filing transactions.

- Transfer at least $250. This takes up to 3 to 5 days to be processed by your financial institution. This is required to verify the banking information you have entered is correct.

Once your deposit account is activated, the funds from subsequent manual and automatic transfers will be immediately available. If you choose to use online banking to transfer funds, you will have a customary 3 to 5 day delay for your financial institution to process your funds transfer request.

Add a Deposit Account

General deposit accounts are not to be used for Property Transfer Tax (PTT) payments. To set up a separate PTT trust account in LTSA Enterprise see: Electronic Funds Transfer for PTT

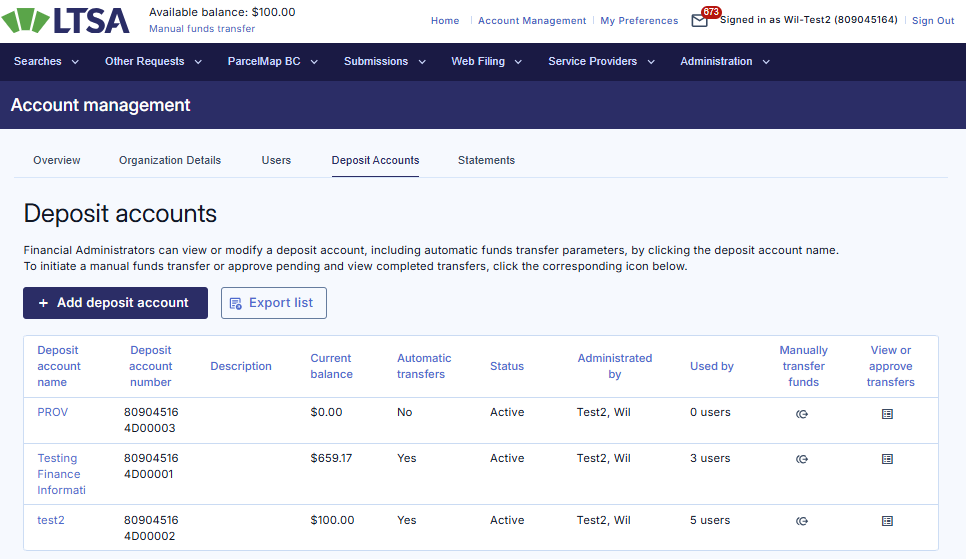

From Account Management, click the Deposit Accounts tab

Click Add Deposit Account

Enter information about the deposit account:

- Deposit Account Name (required field): Enter up to 25 characters to name your deposit account. You may wish to use the department that will transact using the account or the financial institution where the funds are located. Examples are "Conveyancing Department" or "ABC Bank Account #1".

- Description (optional)

- Low Balance Threshold: Set a warning threshold for this deposit account. All Financial Administrators assigned to this account will be notified by email when the balance moves below this threshold.

- Approvals Required for Funds Transfer: Indicate the number of internal signing authorities required to initiate a funds transfer to this deposit account. See Manage Approvals.

Financial Institution Account Information is only required if initiating the electronic fund transfer request via the LTSA web portal using the Initiate fund transfer or Modify automatic funds transfer options.

Enter financial institution account information (see How to Identify Financial Institution Account Information):

- Bank account type: Personal or business

- Financial Institution Number: 3-digit number of your bank or credit union

- Branch/Transit Number: 5-digit number of your bank branch or credit union branch

- Account Number: number of your bank account or credit union account (may be up to 12 digits)

- Bank account legal name: legal name on the associated bank account

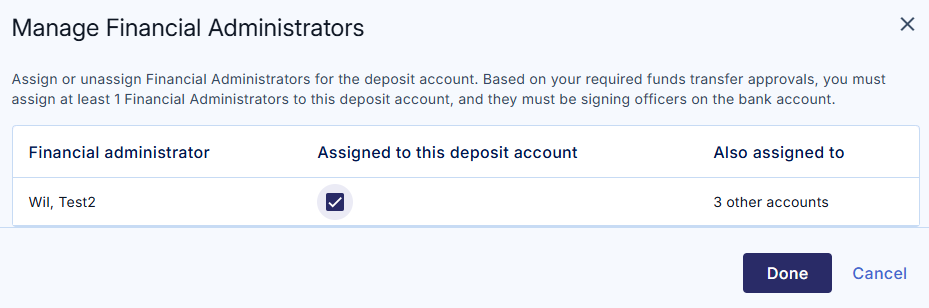

You must assign Financial Administrators to manage your deposit account and those Financial Adminstrators must be signing officers on the bank account.

Assign Financial Administrators:

- Click Assign Financial Administrators (required step)

- Check one or more checkboxes to select Financial Administrators. You will need to check at least as many as the number of approvals required; if there are not enough people on the list then you will need to cancel out of adding the deposit account and add more Financial Administrator users first.

- Click Done

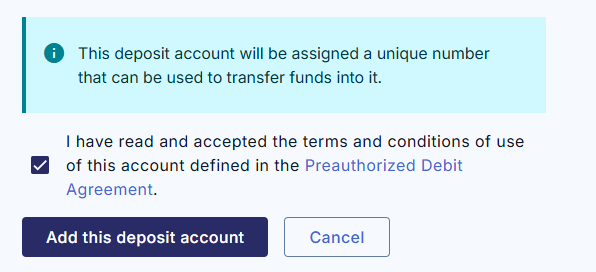

Read the LTSA Enterprise Preauthorized Debit Agreement and click the checkbox to confirm agreement (required steps)

Click Add This Deposit Account

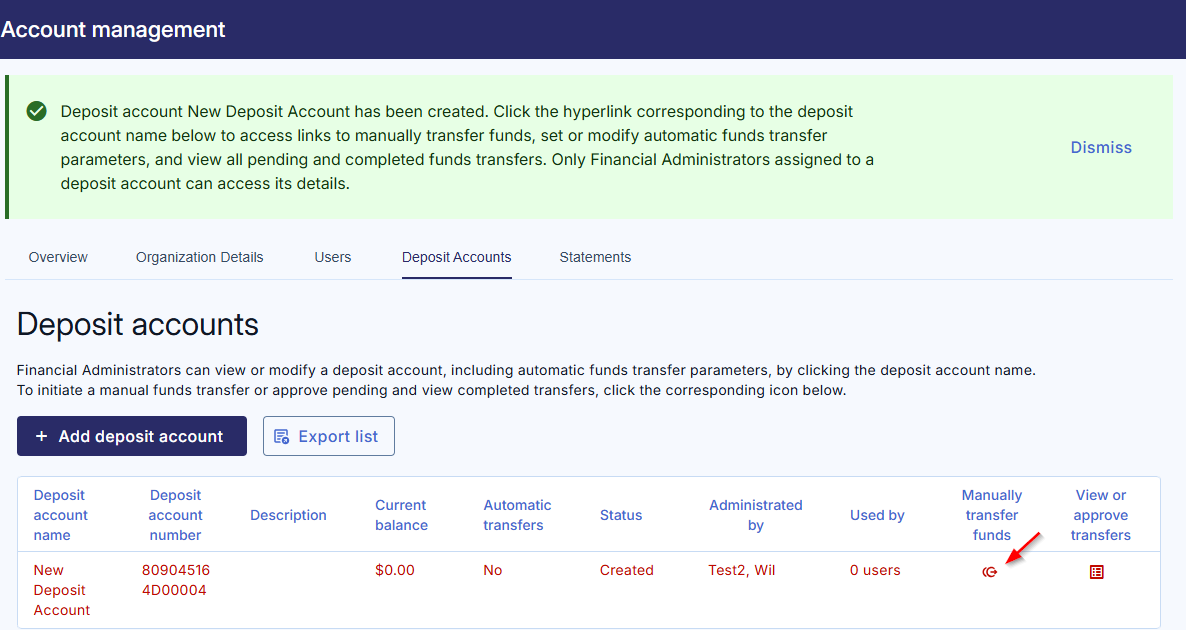

This deposit account will be assigned a unique number that can be used to transfer funds into it. An email confirming the creation of this deposit account with the deposit account number will be sent to the Financial Administrators assigned to manage it. The deposit account number can also be found on the Deposit Account page.

To cancel the transaction and return to the previous page, click Cancel

Manually Transfer Funds to Activate the Account

One of the Financial Administrators assigned to your new deposit account will need to activate it. A funds transfer of at least $250 is required to activate the account. You can also transfer funds using Bill Payment.

The below steps are for initiating a manual fund transfer request from LTSA's deposit account page. For this to work, the correct banking details must already be entered in that deposit account's details page.

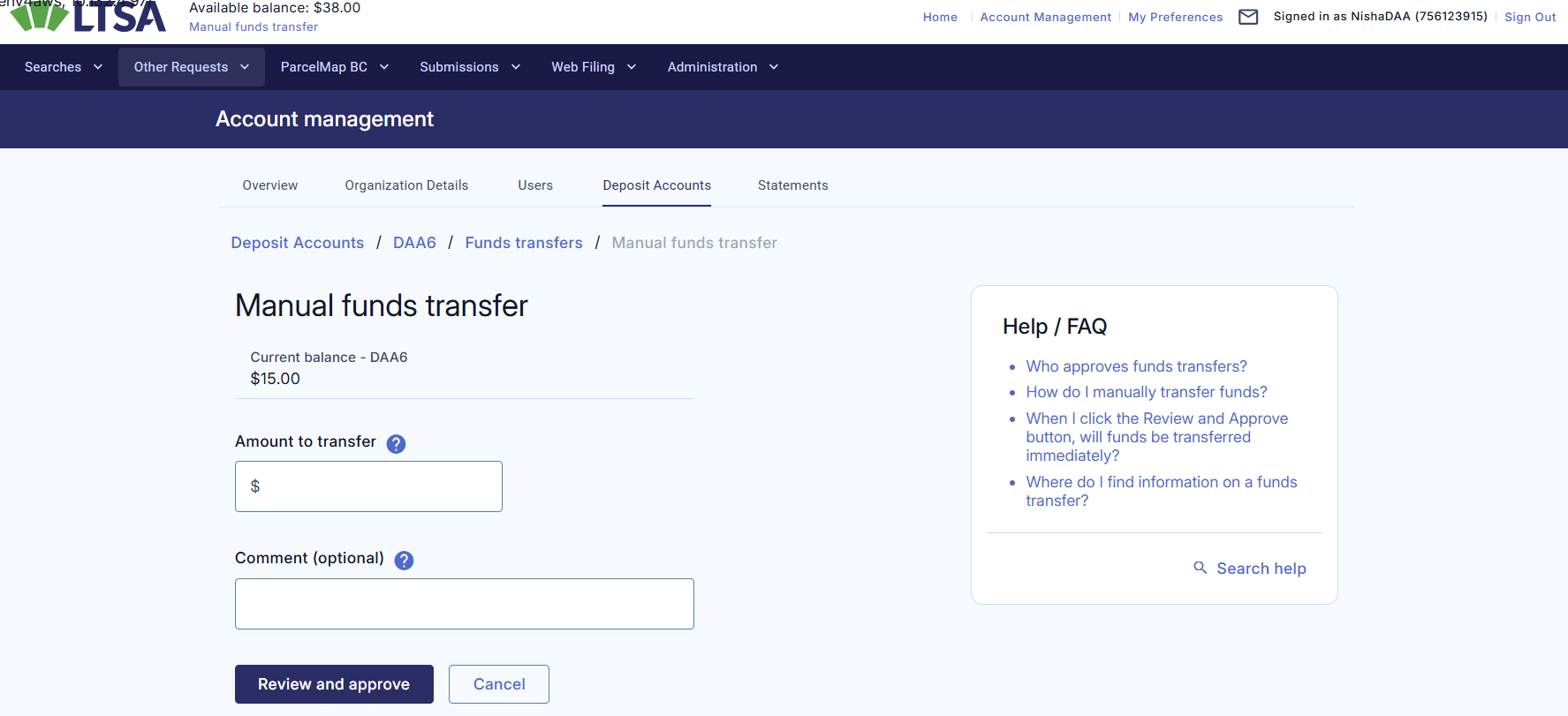

From Account Management, click Deposit Accounts tab

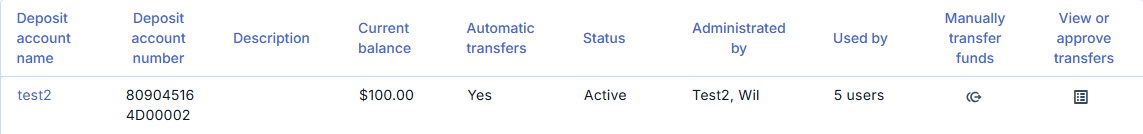

Find the deposit account in the list

In the Manually Transfer Funds column, click the Manually transfer funds icon

You can also transfer funds when you access the deposit account details. Below the Balance Information, click Initiate Manual Funds Transfer.

Enter an amount of $250 or more in the Amount to Transfer field. You must transfer at least $250 to activate your deposit account. You can transfer more than $250 if desired.

Optionally, enter up to 75 characters to explain your funds request in the Comment field

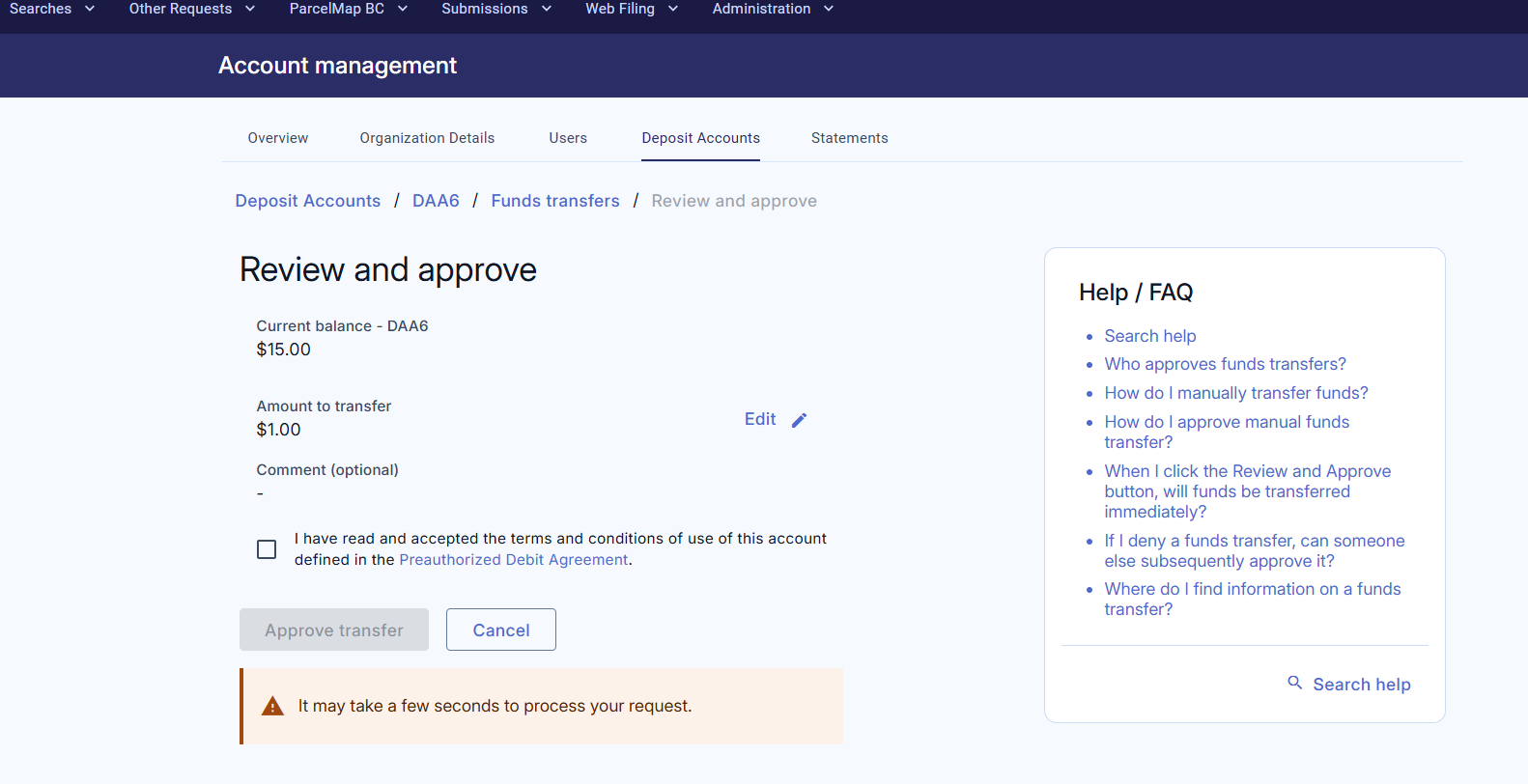

Click Review and Approve to continue. If you wish to modify your funds transfer amount or comment, click Back to return to the previous page.

On the Review and Approve page, read the Preauthorized Debit Agreement and click the checkbox to confirm your agreement

Click Approve Transfer to initiate the transfer

If your Approvals Required for Funds Transfer are set to 2, another Financial Administrator assigned to this deposit account will need to approve the transfer before it can be processed. See: Manage Approvals.

Watching for Your Deposit Account to Activate

You must wait until the initial funds transfer has been processed by your financial institution before your organization can start searching and filing.

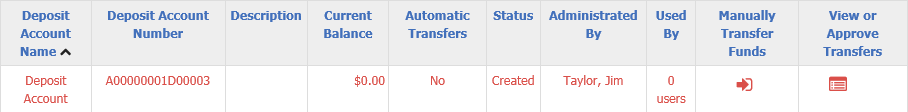

Your deposit account is NOT activated if:

- It displays in "red" on the Deposit Account page

- The status is Created

- Your current balance shows $0.00 since no funds transfer has been initiated

After you initiate your first funds transfer, your deposit account's current balance will display the funds you transferred as its Current Balance; however, those funds are not available to transact with until your deposit account has been activated. This takes up to 3 to 5 days for the financial institution to process.

Your deposit account is activated if:

- It displays in "black" on the Deposit Account page

- The status is Active