On This Page

A transmission to surviving joint tenant application includes a Property Transfer Tax Return under the Property Transfer Tax Act, Land Title Application under the Land Title Act and Transparency Declaration or Declaration of Exclusion under the Land Owner Transparency Act.

To file a Transmission to Surviving Joint Tenant application, you will be asked for the following information:

| 1.1 |

Land Title. It is recommended that you have a copy of the current title to ensure you know the information it contains. Order a copy of the title for a fee before starting the application. To complete the application, you will need to know the:

|

| 1.2 |

Property Transfer Tax. You will automatically be claiming exemption code 08 Survivorship under the Property Transfer Tax Act. This exemption is for a transfer to the survivor of a joint tenancy as a result of the death of a joint tenant. This exempts you from paying Property Transfer Tax. To complete the application, you will need to know the:

If you have questions about the Property Transfer Tax Return, contact the Ministry of Finance, Property Transfer Tax Section, at 236-478-1593 or toll free within BC at 1-888-841-0090 or visit the Property Transfer Tax website. |

| 1.3 |

Land Owner Transparency. Most applications to transmit ownership to a surviving joint tenant must file a transparency declaration as required under the Land Owner Transparency Act. In rare, cases, the transparency declaration can be omitted if the applicant certifies the property is located where the Land Owner Transparency Act does not apply (see section 6 of Land Owner Transparency Act). You will need to know if the application requires a:

Only reporting bodies are required to file a Transparency Report and the online application will ask you questions to determine if you are a reporting body and must file with a legal professional. |

| 1.4 | Permission of the Owner if Filing on Behalf of Someone. If you are applying on behalf of a family member, spouse or other owner on title, you are acting as an agent and must have the permission of that person. |

| 1.5 | BC Services Card app for online submission. The BC Services Card app is used to verify the identity of the applicant and to sign the online application. The applicant may be the surviving owner or someone acting on their behalf. Learn how to log in with the BC Services Card app. If you don’t have the BC Services Card app on your mobile device, you need to set it up first. |

back to top of Transmission to Surviving Joint Tenant

| 2.1 | Before you begin, LTSA will ask questions about the property and ownership to determine if its eligible for online filing. A transmission to surviving joint tenant application includes a Property Transfer Tax Return under the Property Transfer Tax Act, Land Title Application under the Land Title Act and Transparency Declaration or Declaration of Exclusion under the Land Owner Transparency Act. |

Description of Land

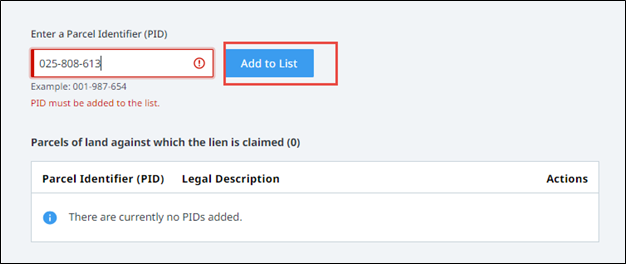

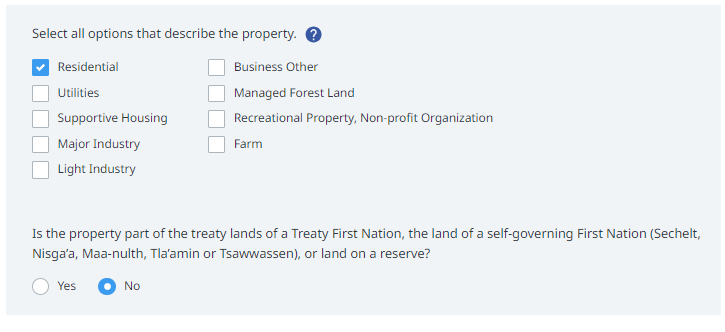

| 2.2 |

Enter one or more nine-digit parcel identifiers (PID) to identify the properties associated with the transmission to surviving joint tenant application. When you click “Add to List”, the system will find and enter the legal description of the property   |

| 2.3 | The maximum number of PIDs that can be entered per form is 100. If you have an application with more than 100 PIDs, you will need to file with a legal professional or in paper form with a schedule of PIDs attached. |

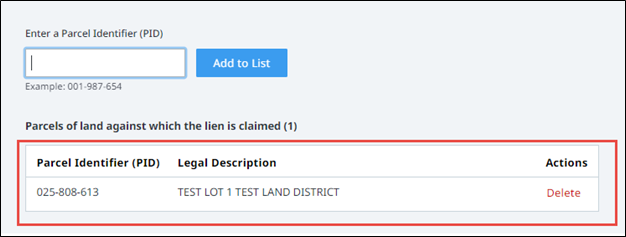

| 2.4 |

If you don’t know the PID, you can find a property’s PID on its title if you have a copy or by searching the address or plan number on the BC Assessment website. You can find the PID to the right of the Property information.  |

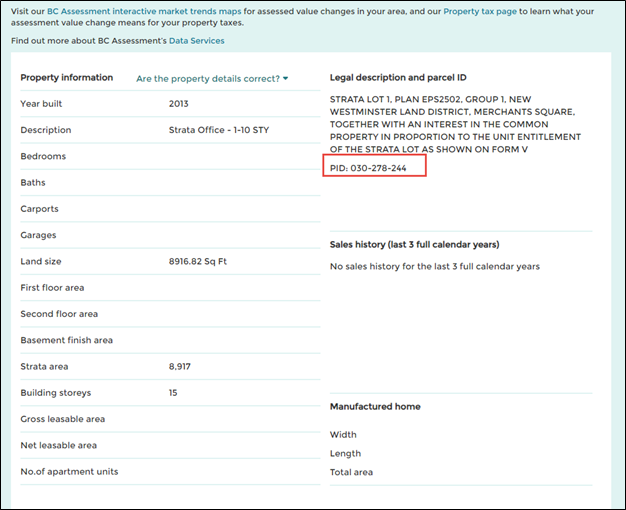

| 2.5 |

Select all options that describe the property and identify if the property is part of treaty lands or a Treaty First Nation.  |

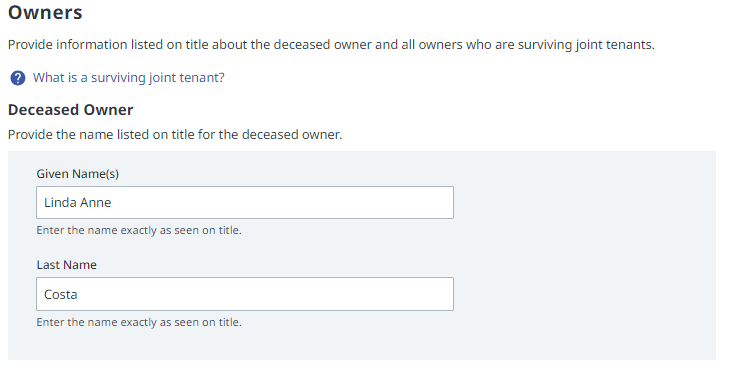

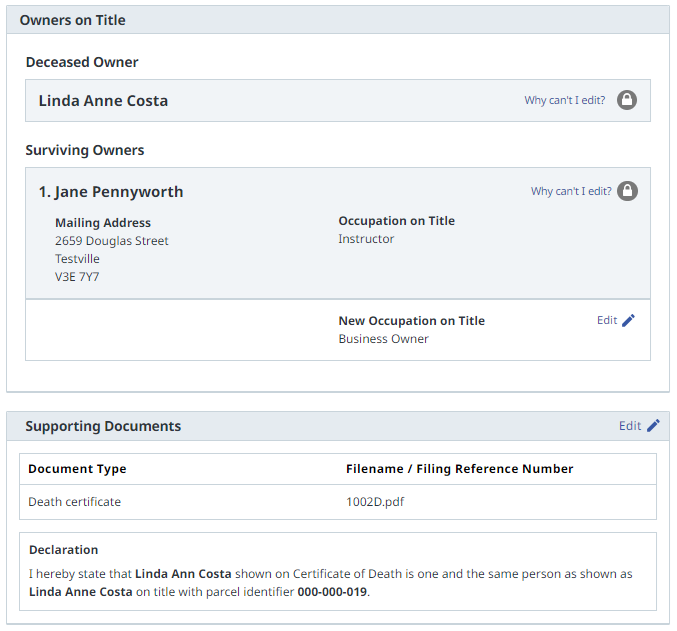

Owners

| 2.6 |

Enter the name of the deceased owner exactly as it appears on title. If the name on title doesn’t match the name in the application or the supporting document, you may experience delays in processing. LTSA recommends you order a copy of the title if you are uncertain how owner names appear on title.  |

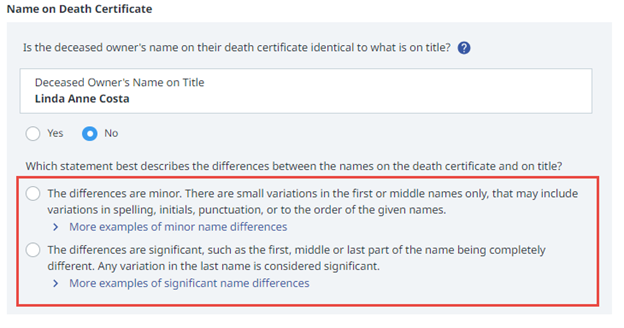

| 2.7 | If there is a discrepancy in the deceased owner name on title and the deceased name on the supporting document, additional evidence to explain the discrepancy is required. The online application will help to determine what type of evidence may be required. |

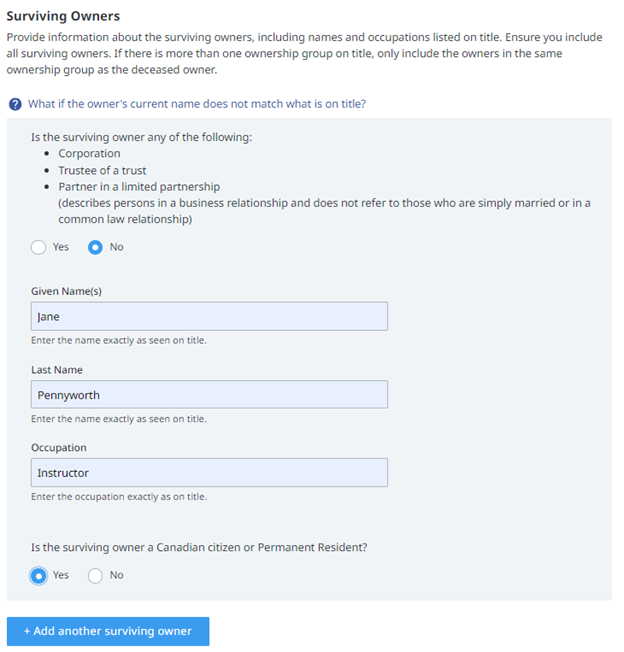

| 2.8 |

Enter the name of the surviving owner(s) as it appears on title. If there is more than one ownership group on title, only include the owners in the same ownership group as the deceased owner.  |

| 2.9 | If the surviving owner name on title isn’t correct, the owner or their agent can file a Change Name on Title application to change the name on title. This will need to be filed as a separate application either before or after this application is filed. |

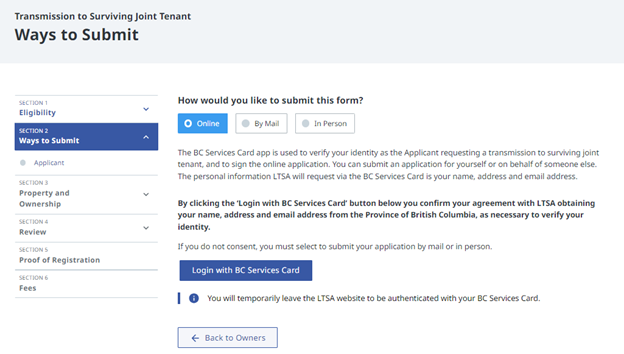

back to top of Transmission to Surviving Joint Tenant

| 3.1 |

You can submit the application online, by mail or in person.  |

| 3.2 | If you choose to submit the form online, you must use your BC Services Card app to login and access the application. LTSA uses the BC Services Card to verify the identity of the applicant. |

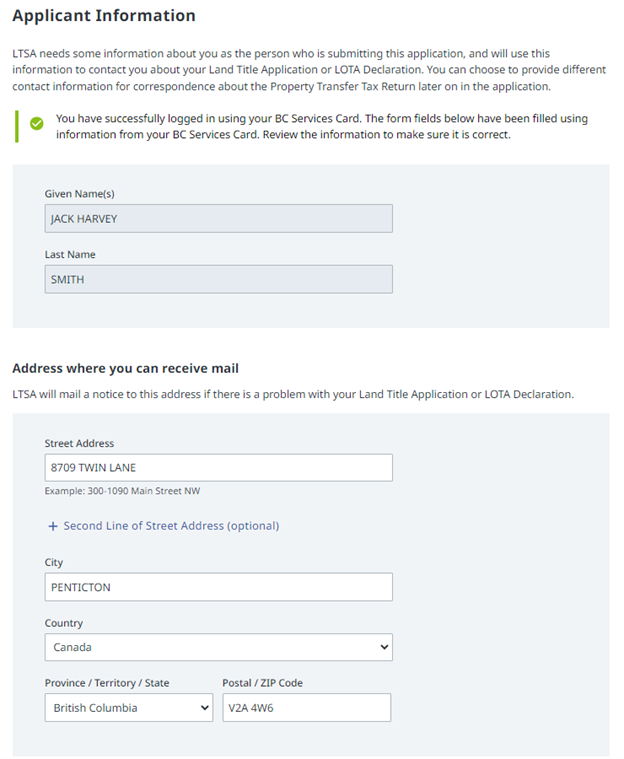

| 3.3 |

For online applications, the name, mailing address and email address (if known) from the BC Services Card is prefilled in the applicant information. The name cannot be changed, but the other information can be updated if needed.   |

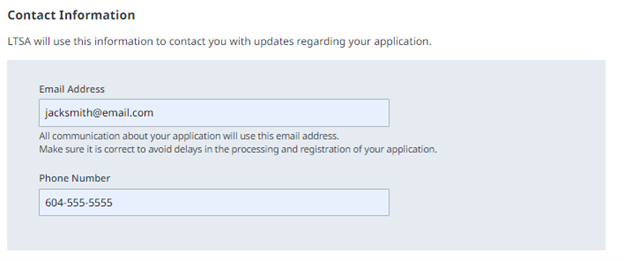

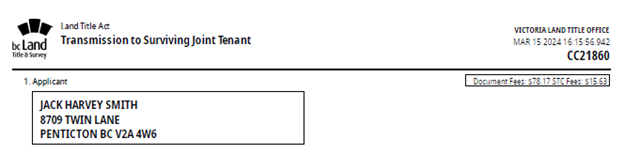

| 3.4 | Complete the email address (if not prefilled by the BC Services Card) and phone number of the applicant. If there is an issue with the application, the LTSA may contact the applicant by email or phone number. |

| 3.5 | If the applicant submits the application online using their BC Services card, all communication related to the Land Title Office processing of the application (e.g. tracking numbers, pending application numbers) is sent to the email address listed in the contact information. |

| 3.6 |

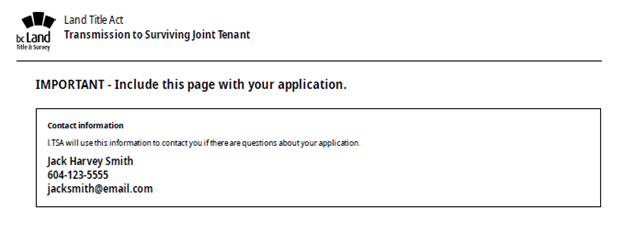

For privacy reasons, the contact information is not listed in the applicant section of the completed application. The contact information is only used to administer the application and is not disclosed in the land title register.  |

| 3.7 |

If submitting by mail or in person, the contact information will be listed on a separate page to the application download. Include this separate page with the application when you submit to the land title office.  |

| 3.8 | If you choose to submit the application by mail or in person, you must fill out the application online and then download, print and sign it with a pen and deliver by mail or by appointment to a land title office in New Westminster, Victoria or Kamloops. |

back to top of Transmission to Surviving Joint Tenant

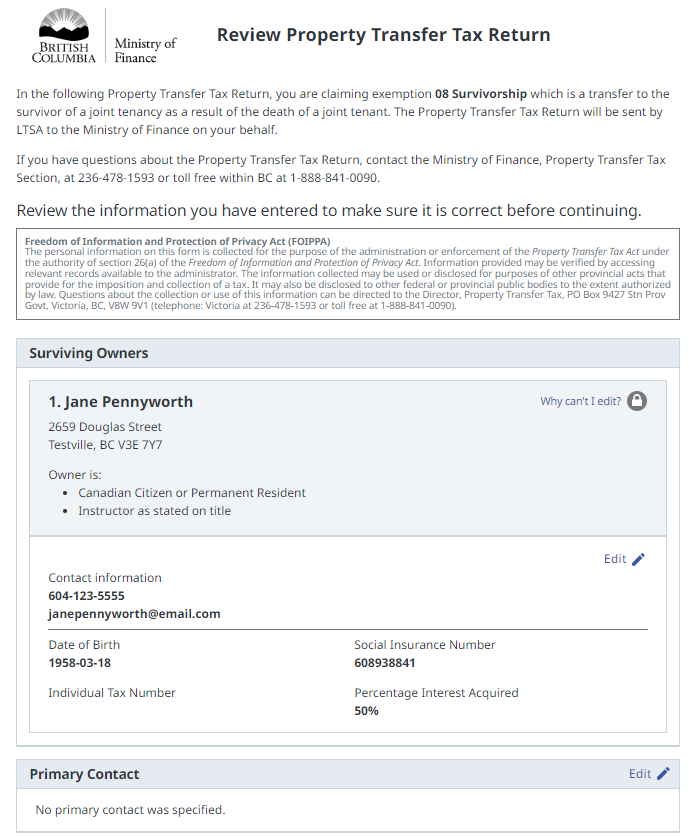

| 4.1 | In the Property Tax Return, you are claiming exemption 08 Survivorship which is a transfer to the survivor of a joint tenancy as a result of the death of a joint tenant. If you have questions about the Property Transfer Tax Return, contact the Ministry of Finance, Property Transfer Tax Section, at 236-478-1593 or toll free within BC at 1-888-841-0090. |

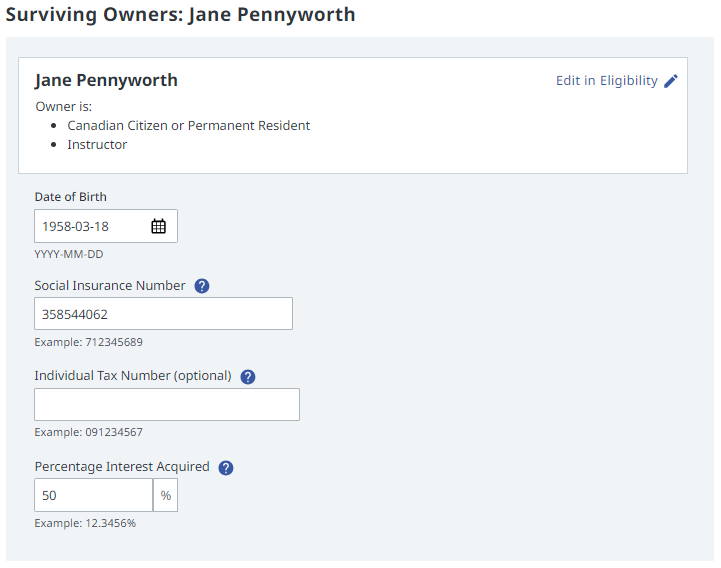

| 4.2 | o successfully submit the Property Tax Return, you must provide a social insurance number (SIN), date of birth of surviving owners and property details from BC Assessment. |

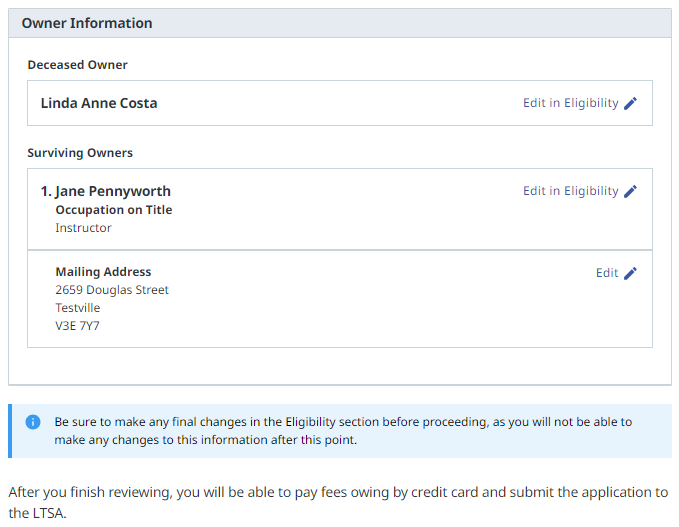

Surviving Owners

| 4.3 |

Enter the surviving owner personal information and property ownership details.  |

| 4.4 |

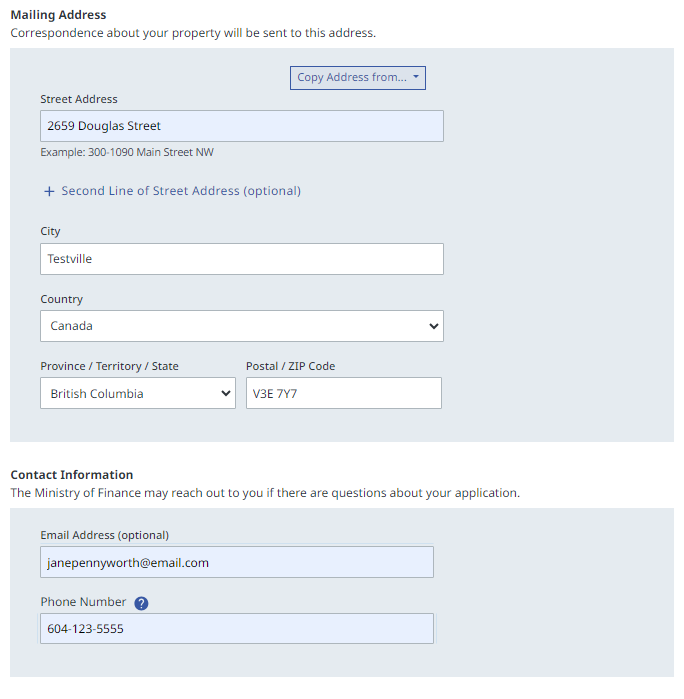

Enter the mailing address for the surviving owner. Correspondence about your property will be sent to this address.  |

| 4.5 |

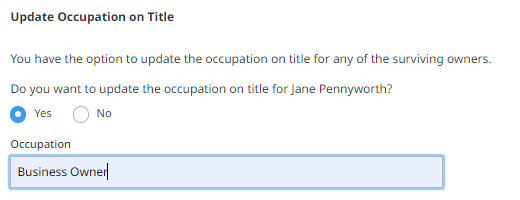

Optionally, you may update occupation in the land title register for any surviving owners.  |

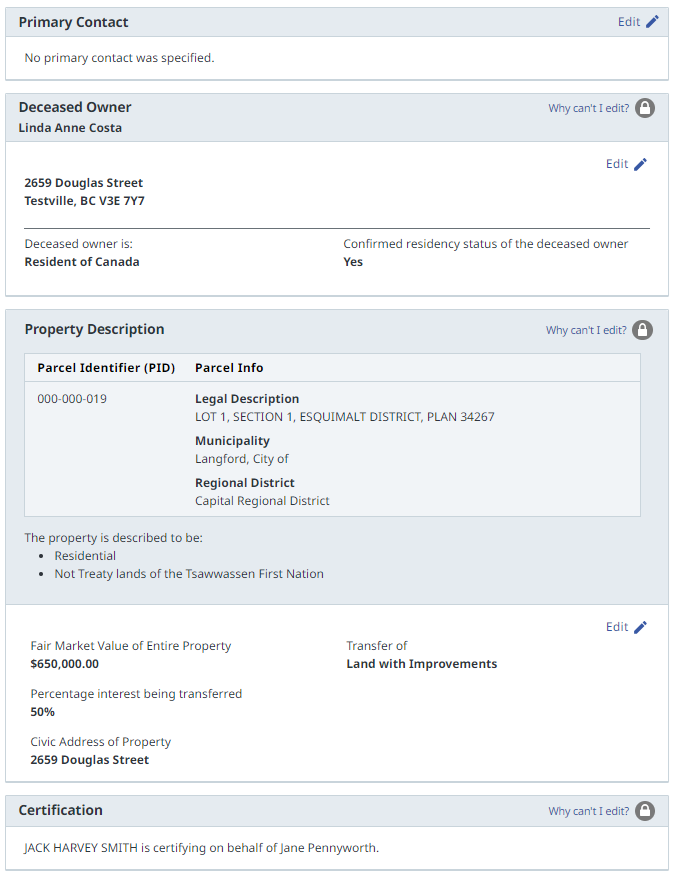

Primary Contact

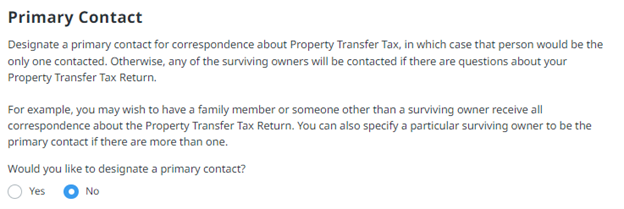

| 4.6 |

Optionally, you can designate a primary contact for correspondence about Property Transfer Tax. Otherwise, any of the surviving joint tenants will be contacted if there are questions about the Property Transfer Tax Return.  |

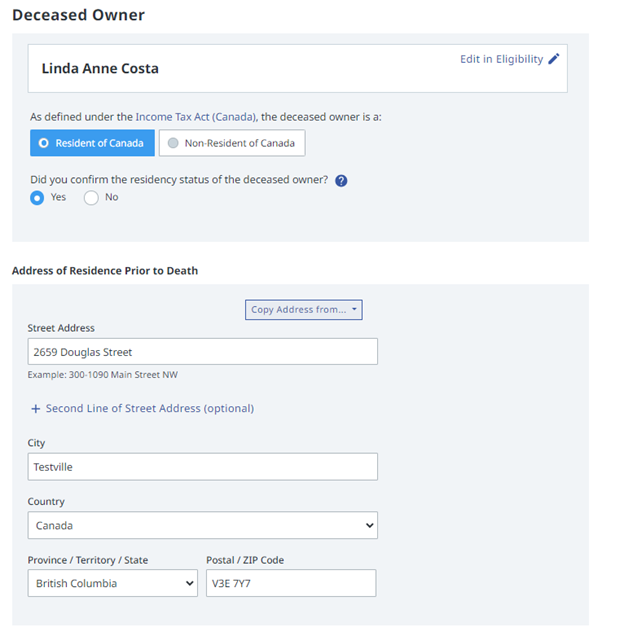

Deceased Owner

| 4.7 |

Enter the residency and address information of the deceased owner.  |

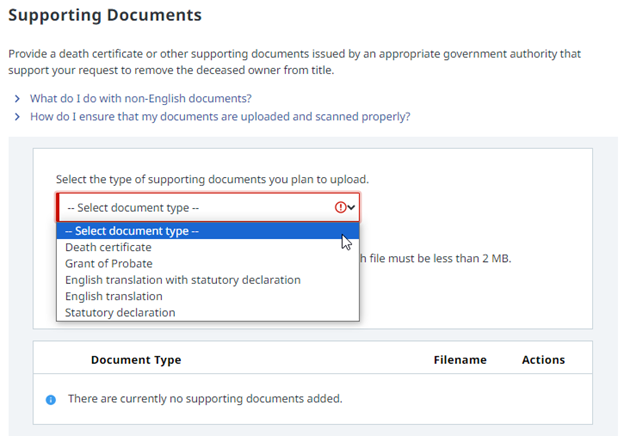

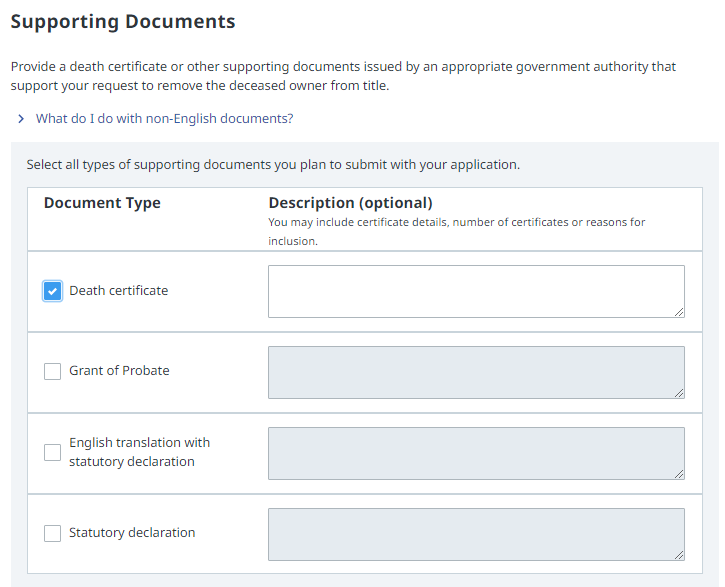

Supporting Documents

| 4.8 | You must provide original supporting documents issued by the appropriate government authority that support the request to remove the deceased owner from title. |

| 4.9 |

Accepted supporting documents under the Land Title Act include a

|

| 4.10 | LTSA will not accept photocopied or notarized copies of supporting documents. A funeral director’s certificate is also not an accepted supporting document. |

| 4.11 |

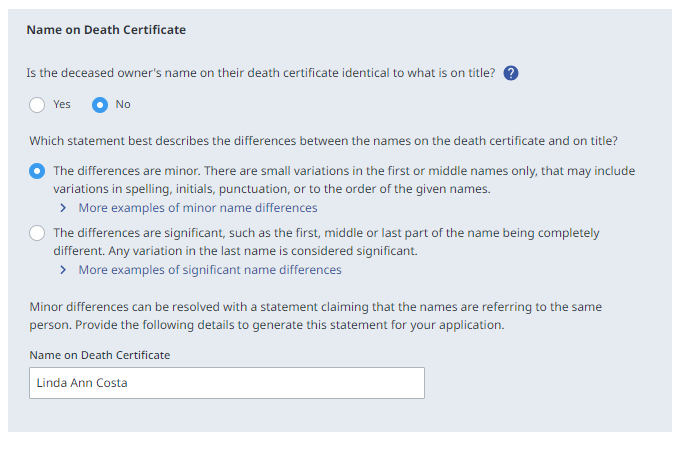

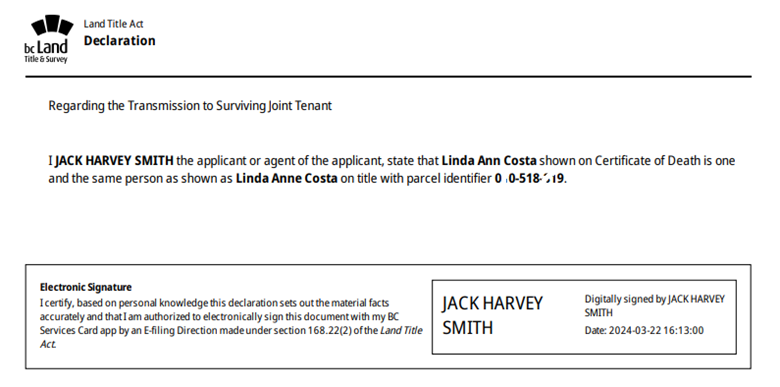

In cases where there is a deceased owner name variation that cannot be explained by a supporting document, LTSA will accept a declaration prepared by the applicant for minor name variations or a statutory declaration prepared and witnessed by a lawyer, notary public or commissioner authorized to administer oath for major name variations. See Transmit Ownership to Surviving Joint Tenant page on ltsa.ca for examples of minor and major name variations.  |

| 4.12 |

In the case of a minor name variation, you can make a statement based on personal knowledge that the deceased owner on the title and on the supporting document is the same person. The system will generate the statement for you when the application is complete.   |

| 4.13 | If any of the supporting documents are non-English, provide an English translation. The translation must be done by someone fluent in both English and the original language used on the document. It does not need to be done by a professional translator. You must also include a statutory declaration signed by the translator, confirming the translation is accurate and true. The statutory declaration must be witnessed by a lawyer, notary public or commissioner authorized to administer oaths. |

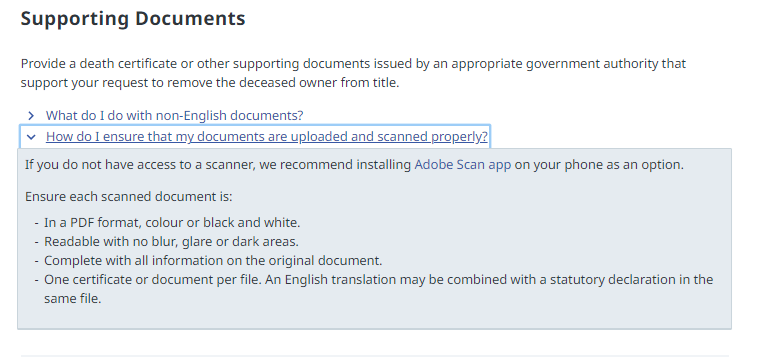

| 4.14 |

If you submit online, you must upload a scan of the original death certificate or grant of probate and any other document needed to support the request to remove the deceased owner from title. The scan must be

|

| 4.15 |

If you submit the application by mail or in person, you must include original certificates and documents with your application. Do not include copies.  |

| 4.16 | If you submit by mail, include a self-addressed stamped envelope so LTSA can return any original certificates to you. If you submit in person, LTSA will return the original certificates to you at your appointment. |

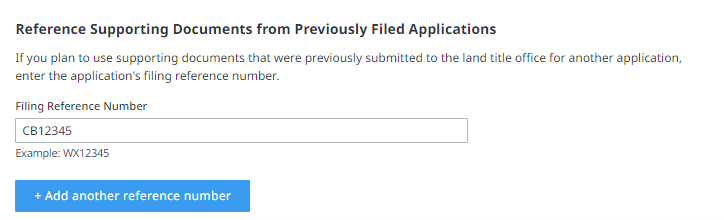

| 4.17 |

If you have submitted the supporting document with a different application, you can enter the application number in the Filing Reference Number field instead of uploading the supporting document again.  |

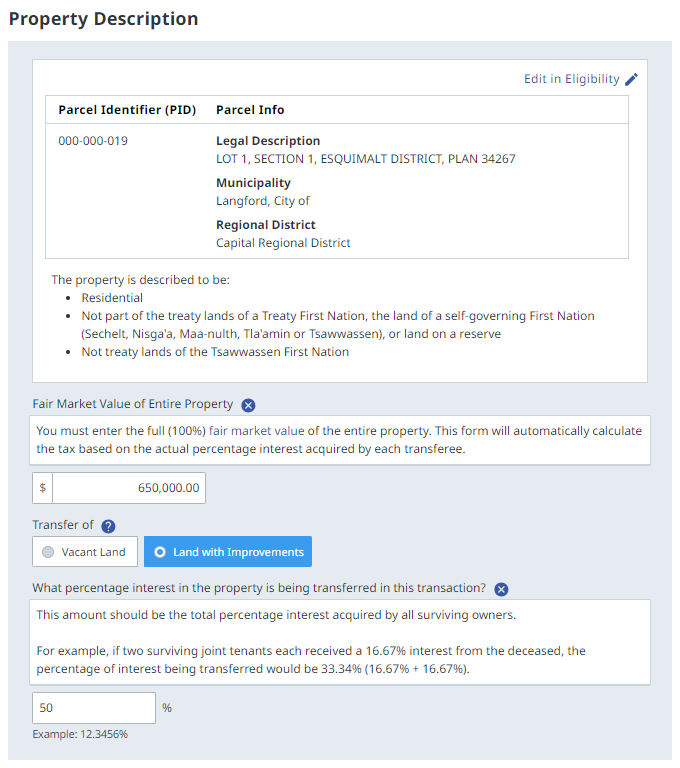

Property Description

| 4.18 | Review and edit the property description, if needed. |

| 4.19 |

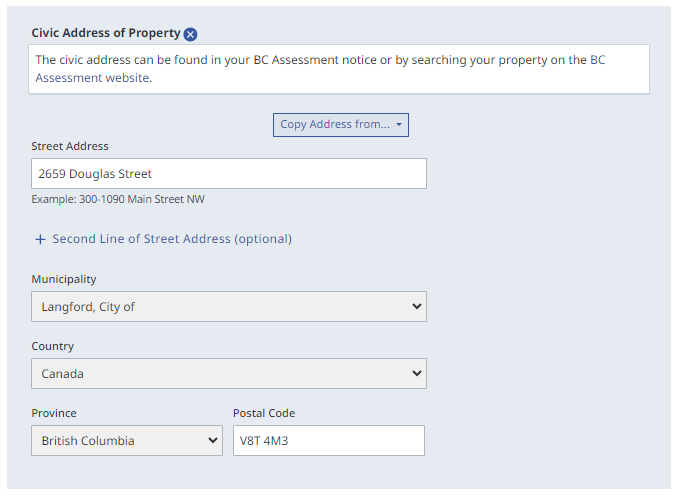

Enter the Fair Market Value of Entire Property, the type of transfer and the percentage of interest being transferred. You also need to complete the civic address of the property.   |

back to top of Transmission to Surviving Joint Tenant

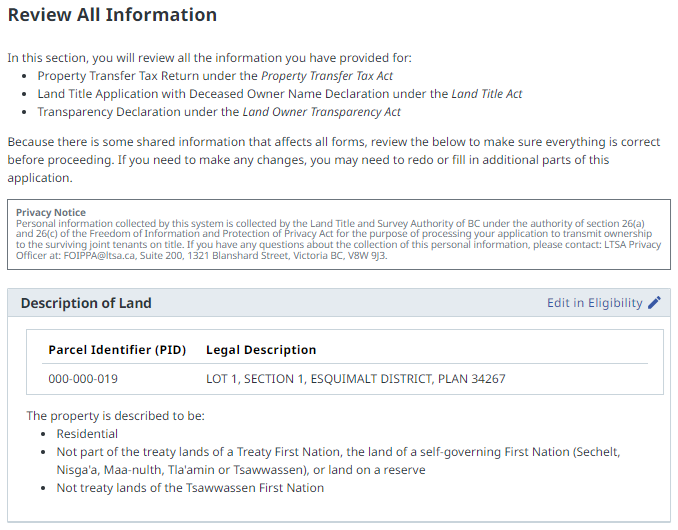

| 5.1 |

After reviewing the shared information, you can review and edit the shared information before continuing to review information provided for each form. The shared information affects all forms and should be carefully reviewed before proceeding.   |

Property Transfer Tax Return

| 5.2 |

After completing the data entry fields, you can review and edit the information about the Property Transfer Tax Return. If you need to make a change, click the Edit button to access the information you wish to change.   |

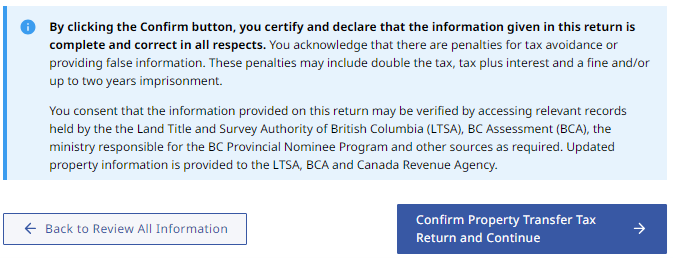

| 5.3 |

Before the application can be submitted, you must certify and declare that the information given in the return is complete and correct in all aspects.  |

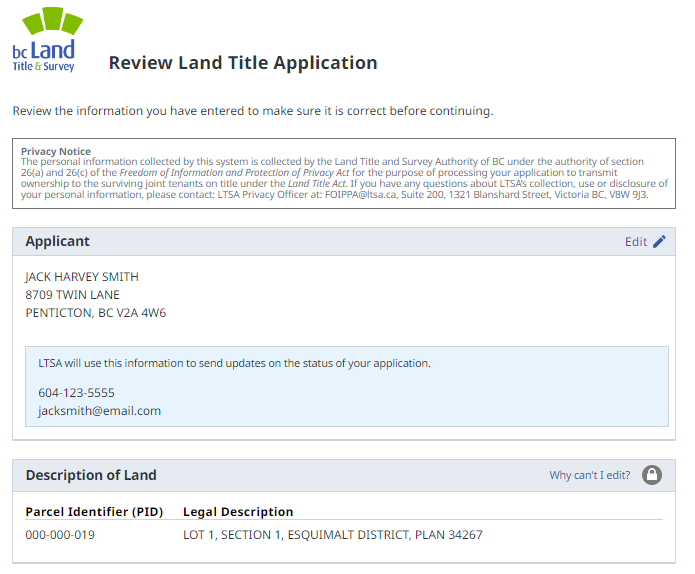

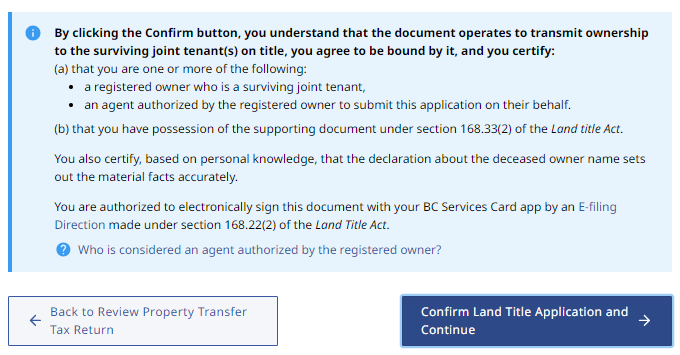

Land Title Application

| 5.4 |

After reviewing the Property Transfer Tax Return, you can review and edit the information about the Land Title Application. If you need to make a change, click the Edit button to access the information you wish to change.   |

| 5.5 |

Before the application can be submitted, you must acknowledge and complete a certification statement under the Land Title Act.  |

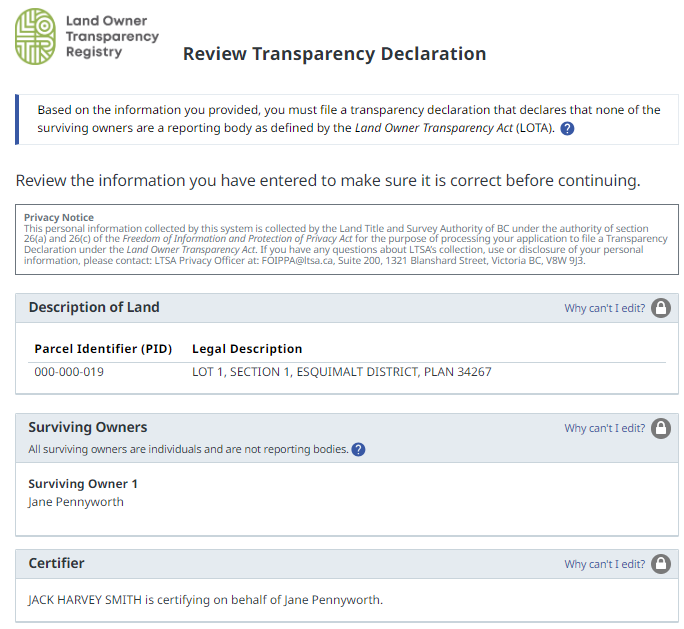

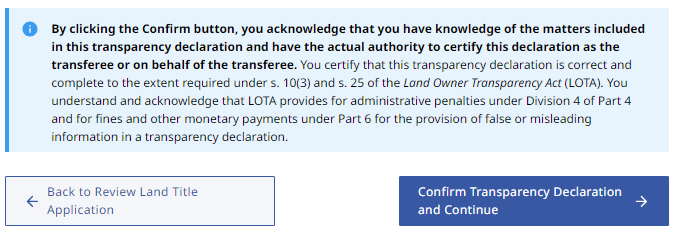

LOTA Declaration

| 5.6 |

After reviewing the Land Title Application, you can review the information about the Transparency Declaration. If you need to make a change, return to the Eligibility section to access the information you wish to change. The information in the Eligibility section is shared between multiple forms and any change may require additional changes to other forms.  |

| 5.7 |

Before the application can be submitted, you must acknowledge and complete a certification statement under the Land Owner Transparency Act.  |

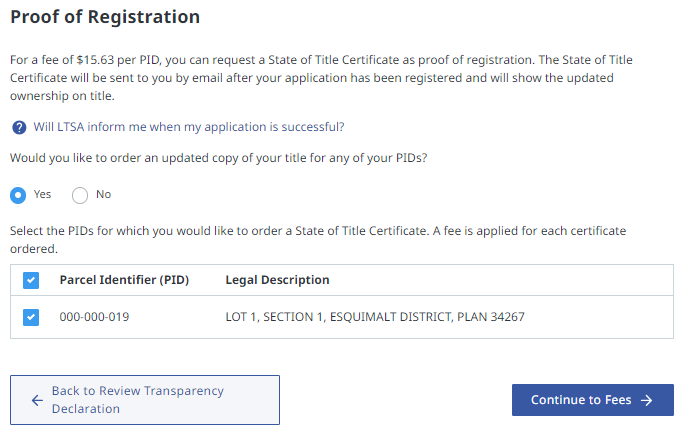

back to top of Transmission to Surviving Joint Tenant

| 6.1 |

If you would like proof of registration, for a fee you can order a State of Title Certificate, which will be emailed to you if you submit online or mailed to you if you submit in paper by mail or in person. The certificate will be delivered to you after the Transmission to Surviving Joint Tenant application is registered.  |

back to top of Transmission to Surviving Joint Tenant

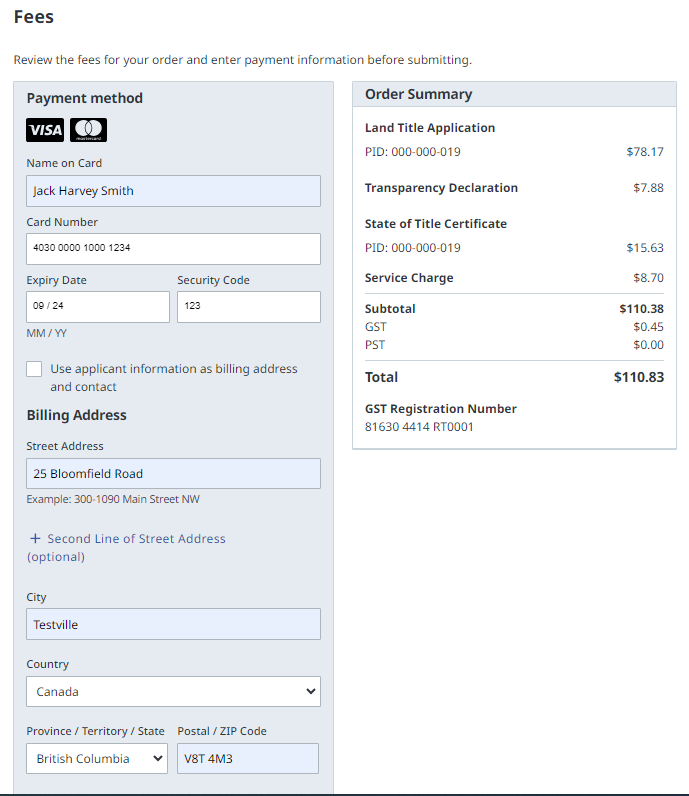

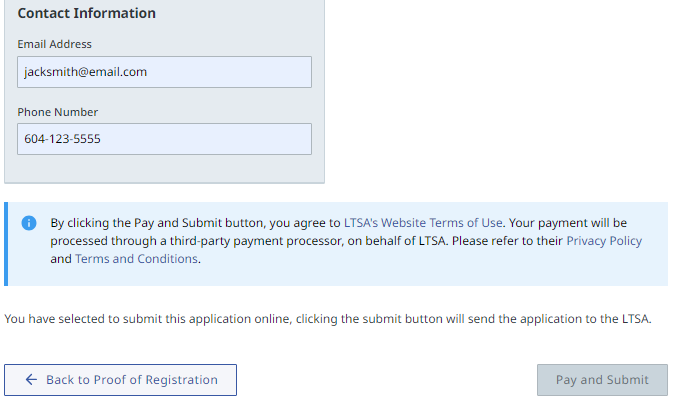

| 7.1 |

If you submit the application online, enter the payment method and billing information.   |

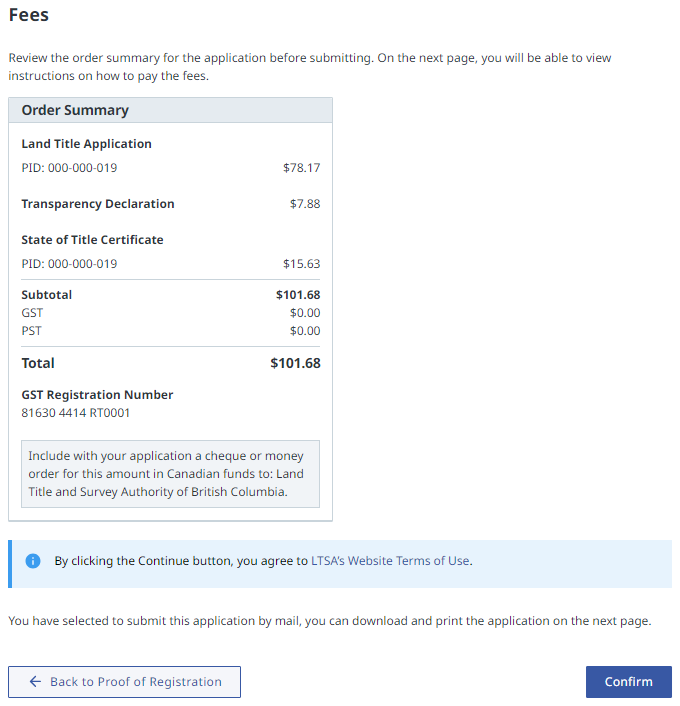

| 7.2 |

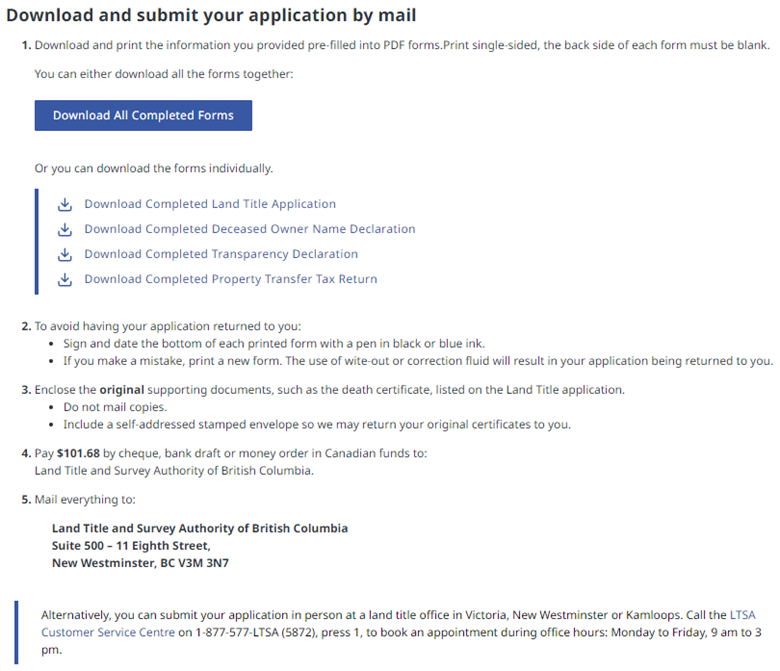

If you submit the application by mail or in person, review the order summary before submitting.  |

back to top of Transmission to Surviving Joint Tenant

SUBMIT AND DOWNLOAD THE APPLICATIONS

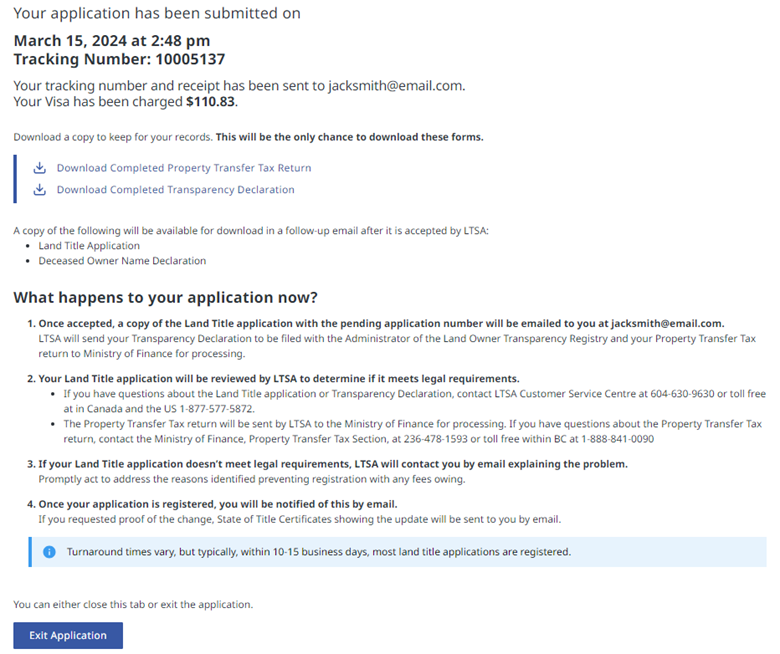

| 8.1 | After you choose to submit online, download a copy of the Property Transfer Tax Return and Transparency Declaration for your record. This is the only time these documents will be available for download. Once they are submitted to the land title office, the documents are sent to the Ministry of Finance and Land Owner Transparency Registry for processing. |

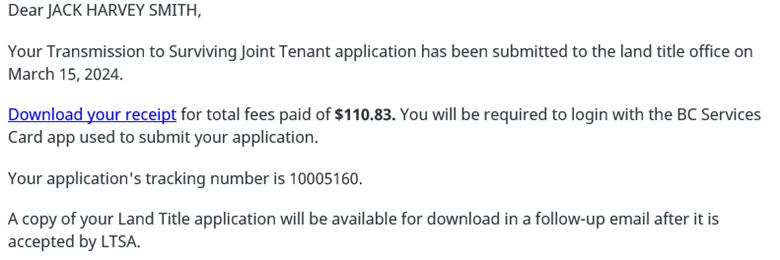

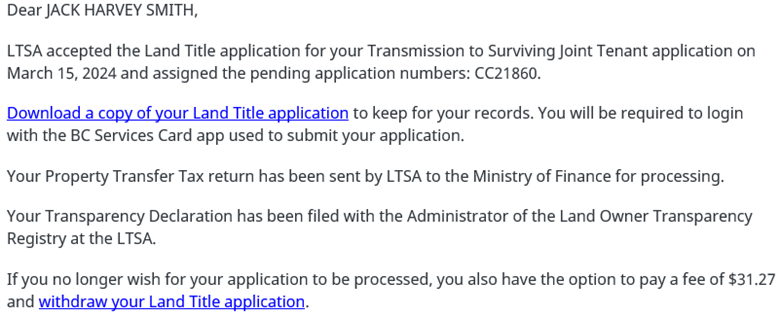

| 8.2 |

The application will be sent electronically to the land title office. Your tracking number, a link to download the receipt and, once assigned for review, a pending application number and link to withdraw the application will be sent to the email address entered in the form.    |

| 8.3 | In cases where you no longer want to file the application, you can withdraw it before registration. Once an application is withdrawn it cannot be reinstated. Online applications can be withdrawn by a link included in the automated acceptance email. For applications submitted in person or by mail, you will need to contact the LTSA Customer Support about submitting a withdraw request. |

| 8.4 |

If you choose to submit the application by mail or in person, you must download the completed applications and sign and date them with a pen in black or blue ink. You can then mail it to the New Westminster Land Title Office or contact the LTSA Customer Service Centre to make an appointment to deliver it in person to a land title office in New Westminster, Victoria or Kamloops.  |

| 8.5 | Include a stamped self-addressed envelope with your mailed application to receive a copy of the application with the pending application number. |

| 8.6 |

To avoid having any of the applications returned to you:

|

| 8.7 | After the application is submitted to the land title office, the Land Title application and the Transparency Declaration will be reviewed by LTSA to determine if it meets legal requirements. If the Land Title application doesn’t meet legal requirements, you will be contacted with an explanation of the problem via Canada Post mail or, if the application was submitted online, via email. The Property Transfer Tax Return will be sent to Ministry of Finance for processing. |

back to top of Transmission to Surviving Joint Tenant

AFTER THE APPLICATION IS REGISTERED

| 9.1 | If you submit online with the BC Services Card app, you will be notified by email when your application is registered. |

| 9.2 | If you ordered a State of Title Certificate with the online application, it will be delivered to you by email after the application is registered. |

| 9.3 | If you submit by mail or in person and you’d like to be notified of registration, you must purchase a State of Title Certificate. Include a cheque in Canadian funds for $16.25 payable for each parcel (PID) to: Land Title and Survey Authority of British Columbia |